This scenario is more common than you’d think. Payment gateways, the behind-the-scenes heroes of online transactions, play a massive role in your store’s conversion rates. A smooth, secure, and customer-friendly payment experience is non-negotiable. That’s why we’re diving deep into the world of WooCommerce payment gateways.

In this ultimate guide, you’ll learn everything you need to choose the right payment gateways, set them up effortlessly, and optimize your checkout process for maximum sales and happy customers. Whether you’re just starting out or looking to upgrade your payment system, this guide will arm you with the knowledge you need.

Think of payment gateways as the digital bridges between your WooCommerce store and your customer’s bank accounts. They handle the sensitive task of processing credit cards, bank transfers, and other payment methods. By partnering with reliable payment gateways, you build trust with your shoppers and ensure that their financial information is protected.

Get ready to boost those sales numbers! Let’s get started.

Understanding Payment Gateways

What is a Payment Gateway

A payment gateway is the technology that makes online transactions possible. It acts like a secure, virtual point-of-sale terminal, allowing your WooCommerce store to accept and process payments from customers worldwide. When a customer enters their payment details on your checkout page, the payment gateway does the following:

- Encrypts Sensitive Data: The customer’s credit card information or bank details are shielded from prying eyes, ensuring a safe transaction.

- Communicates with Banks: The gateway talks to the customer’s bank (issuing bank) and your business’s bank (acquiring bank) to verify funds and authorize the transaction.

- Relays Approval or Decline: Within seconds, the payment gateway sends back a confirmation or decline message, determining whether the sale goes through.

In essence, a payment gateway acts as a trusted middleman, safeguarding your customer’s financial information and facilitating the smooth flow of funds into your business account.

Types of Payment Gateways

Not all payment gateways are created equal. Here’s a breakdown of the main categories you’ll encounter:

- On-site Gateways (also called Redirect Gateways): With this type, customers are temporarily redirected to the payment provider’s secure website to complete the transaction. Popular examples include PayPal Standard and Stripe. On-site gateways are often easier to set up, but they slightly disrupt the checkout flow as customers leave your site momentarily.

- Off-site Gateways (also called Integrated Gateways): These gateways offer a more seamless experience by allowing customers to enter their payment details directly on your checkout page. The information is then securely transmitted to the payment gateway’s servers for processing. Popular choices include Stripe, Authorize.Net, and Braintree. This option often provides a smoother user experience.

- Direct Gateways (also called Self-Hosted Gateways): For maximum control (but also increased responsibility), direct gateways process payments directly on your server. This requires strict adherence to security standards (PCI DSS) and generally involves a more complex setup.

Which type is right for you? Consider these factors:

- Ease of setup: On-site gateways typically offer the fastest integration.

- Checkout experience: Off-site gateways keep customers on your site, enhancing brand consistency and boosting conversions.

- Customization: Off-site and direct gateways generally offer more options to tailor the checkout flow to match your store’s design.

- Security: Direct gateways demand the highest level of security compliance from you.

Grow Your Sales

- Incredibly Fast Store

- Sales Optimization

- Enterprise-Grade Security

- 24/7 Expert Service

- Incredibly Fast Store

- Sales Optimization

- Enterprise-Grade Security

- 24/7 Expert Service

- Prompt your Code & Add Custom Code, HTML, or CSS with ease

- Generate or edit with AI for Tailored Images

- Use Copilot for predictive stylized container layouts

- Prompt your Code & Add Custom Code, HTML, or CSS with ease

- Generate or edit with AI for Tailored Images

- Use Copilot for predictive stylized container layouts

- Craft or Translate Content at Lightning Speed

Top-Performing Website

- Super-Fast Websites

- Enterprise-Grade Security

- Any Site, Every Business

- 24/7 Expert Service

Top-Performing Website

- Super-Fast Websites

- Enterprise-Grade Security

- Any Site, Every Business

- 24/7 Expert Service

- Drag & Drop Website Builder, No Code Required

- Over 100 Widgets, for Every Purpose

- Professional Design Features for Pixel Perfect Design

- Drag & Drop Website Builder, No Code Required

- Over 100 Widgets, for Every Purpose

- Professional Design Features for Pixel Perfect Design

- Marketing & eCommerce Features to Increase Conversion

- Ensure Reliable Email Delivery for Your Website

- Simple Setup, No SMTP Configuration Needed

- Centralized Email Insights for Better Tracking

- Ensure Reliable Email Delivery for Your Website

- Simple Setup, No SMTP Configuration Needed

- Centralized Email Insights for Better Tracking

- Ensure Reliable Email Delivery for Your Website

- Simple Setup, No SMTP Configuration Needed

- Centralized Email Insights for Better Tracking

Crucial Factors in Choosing a Gateway

Selecting the right payment gateway involves more than just understanding the different types. Here’s a deep dive into the key factors you absolutely must consider:

Transaction Fees

- Processing Fees: Expect a percentage-based fee on each transaction, usually plus a small flat fee. These can vary between payment gateways.

- Setup Fees: Some gateways may charge a one-time setup fee.

- Chargeback Fees: Disputes or fraudulent transactions can result in chargeback fees from payment providers.

- Monthly or Annual Fees: Certain gateways may have recurring fees in addition to per-transaction costs.

Tip: Look for transparent pricing structures with no hidden fees. Factor in your expected sales volume to accurately compare the overall costs of different gateways.

Security

- PCI DSS Compliance: Payment Card Industry Data Security Standard is a must. Choose gateways that meet the most up-to-date PCI standards for handling sensitive cardholder data.

- SSL Certificates: Ensure your gateway (and store) uses an SSL certificate for secure, encrypted transmission of customer information.

- Fraud Prevention Features: Look for gateways offering built-in fraud detection tools, such as address verification (AVS), card verification codes (CVV), and advanced risk analysis.

Supported Countries & Currencies

- Geographic Reach: If you sell internationally, ensure your gateway supports the countries where your customers are located.

- Multi-currency Support: For global sales, you’ll need a gateway that handles currency conversions effectively.

Customer Experience

- Ease of Use: A clear, intuitive checkout process is crucial for conversions. Opt for gateways with user-friendly interfaces and minimal steps.

- Payment Method Options: Support popular credit/debit cards, and consider options like PayPal, Apple Pay, Google Pay, and regional payment methods based on your target audience.

- Mobile Optimization: With mobile shopping on the rise, your payment gateway must provide a seamless experience on smaller screens.

Compatibility & Integration Ease

- WooCommerce Compatibility: Verify that the gateway works seamlessly with your WooCommerce store. Most popular gateways offer plugins or extensions for easy integration.

- Technical Expertise: Consider your (or your developer’s) level of technical knowledge. Some gateways have simpler setup processes than others.

- API Documentation: If customization is important, look for gateways with clear, well-structured developer documentation for easier integrations.

Recurring Payments & Subscription Support

- Subscription Functionality: If you offer subscriptions or recurring billing, ensure your gateway has robust support for these payment models.

- Automated Billing: The gateway should handle automatic recurring payments, saving you time and minimizing missed payments.

Customer Support & Reliability

- Support Availability: Choose a gateway with reliable support channels (phone, email, live chat) in case you encounter issues. 24/7 support is ideal for critical payment problems.

- Uptime: Look for a gateway with a proven track record of high uptime so you don’t lose sales due to technical glitches.

- Reputation: Research the gateway’s reputation. Check online reviews and forums for insights into their customer service and reliability.

Setting Up Payment Gateways in WooCommerce

WooCommerce’s Built-In gateways

WooCommerce comes equipped with a few default payment gateways to get you started quickly:

- PayPal Standard: This popular on-site gateway redirects customers to PayPal to complete their payments.

- Direct Bank Transfer (BACS) allows customers to pay directly into their bank account (manual order processing is required).

- Check Payments: Customers pay by mailing a check (manual order processing required).

- Cash on Delivery (COD): Customers pay in cash upon receipt of their order.

While convenient, these built-in options might offer limited features or higher fees compared to dedicated third-party gateways.

WooCommerce’s third-party gateways

*** I have tried to add all the relevant information: general information, routes, monthly costs, and fees – but keep in mind that the prices of the fees or costs found here may not be up-to-date.

1. Stripe

- A super easy setup and a user-friendly interface make it a top choice.

- Transparent transaction fees.

- Supports a wide range of global currencies and payment methods.

- Pricing: 2.9% + $0.30 per successful card charge.

2. PayPal

- One of the most trusted and widely recognized payment brands.

- Offers buyer protection and fraud prevention features.

- Great for international transactions.

- Pricing: 2.9% + $0.30 per domestic transaction (rates vary for international transactions).

3. Square

- Excellent for businesses that also need point-of-sale (POS) solutions.

- Flat-rate pricing keeps things simple.

- Offers features like invoicing and inventory management.

- Pricing: 2.6% + $0.10 per in-person transaction; 2.9% + $0.30 per online transaction.

4. Amazon Pay

- Leverages the familiarity and trust of Amazon.

- Seamless integration for customers with Amazon accounts.

- Competitive pricing structure.

- Pricing: 2.9% + $0.30 per domestic transaction (additional fees may apply).

5. Authorize.Net

- Robust security and fraud prevention features.

- Long-standing payment gateway with a reliable reputation.

- Suitable for businesses of all sizes.

- Pricing: $25 monthly gateway fee + 2.9% + $0.30 per transaction.

6. Braintree (a PayPal company)

https://www.braintreepayments.com/

- Advanced features like recurring billing and fraud protection tools.

- Accepts a wide range of payment methods.

- It can be customized to fit specific business needs.

- Pricing: 2.9% + $0.30 per transaction.

7. 2Checkout

- Great for international sales, supporting a vast range of currencies.

- Simplified checkout process for customers.

- Built-in subscription billing options.

- Pricing: 2.9% + $0.30 per transaction (higher tiers offer lower rates).

8. Klarna

- Popular “Buy Now, Pay Later” installment payment solution.

- Can increase conversion rates by offering flexible payment options.

- Extensive marketing support for merchants.

- Pricing: Variable rates depending on the payment plan.

9. Worldpay

- Global payment processing with support for various currencies.

- Advanced fraud detection and risk management tools.

- Scalable solutions for growing businesses.

- Pricing: Custom pricing model based on business needs.

10. Adyen

- Optimized for global e-commerce with localized payment options.

- Unified platform for managing payments across channels.

- Data-driven insights to improve payment performance.

- Pricing: Processing fee + payment method fee.

11. Payoneer

- Ideal for businesses that need to make and receive cross-border payments.

- Offers competitive exchange rates.

- Provides multiple payout options for businesses.

- Pricing: This varies depending on the type of transactions and payout method.

12. Skrill

- Popular for online gaming and gambling transactions, but also supports e-commerce.

- Provides fast and secure global transactions.

- Offers prepaid card solutions for merchants and customers.

- Pricing: Variable rates, typically around 1.45% + €0.50 for merchants.

13. WePay (a Chase company)

- Tailored for platforms and marketplaces, facilitating payments between multiple parties.

- Built-in risk management and compliance tools.

- Easy integration with WooCommerce.

- Pricing: 2.9% + $0.30 per transaction.

14. Alipay

- Essential for accessing the Chinese market.

- Preferred payment method for millions of Chinese consumers.

- Offers cross-border payment solutions.

- Pricing: Variable rates depending on the transaction volume.

15. Razorpay

- Popular payment gateway in India.

- Supports a wide range of Indian payment methods.

- Easy setup and integration process.

- Pricing: 2% per transaction (fees may vary based on payment method).

16. BlueSnap

- The all-in-one payment platform focused on global sales and B2B transactions.

- Integrated fraud prevention and chargeback management.

- Supports subscription billing and recurring payments.

- Pricing: 2.9% + $0.30 per transaction.

17. Sage Pay

- Reliable payment gateway with a strong presence in the UK.

- Fraud screening tools and secure payment processing.

- Offers phone and online support.

- Pricing: Custom pricing model based on business requirements.

18. PayU

- Popular in Latin America, India, and other emerging markets.

- Local payment method expertise in various regions.

- One-click payments for improved customer experience.

- Pricing: This varies depending on the country and payment method.

19. Mollie

- User-friendly payment gateway is popular in Europe.

- Easy integration and no setup fees.

- Wide range of supported payment methods.

- Pricing: Transaction-based fees with no monthly costs.

20. eWay

- https://www.eway.com.au/

- Leading payment gateway in Australia and New Zealand.

- The rapid onboarding process for merchants.

- Advanced fraud protection tools.

- Pricing: Monthly fee + transaction-based fees.

Always double-check the latest pricing, feature sets, and supported countries on the official website of each payment gateway before making your final decision.

Installing and Configuring Popular Gateways

Get Your API Keys or Credentials

- Create a Gateway Account: Sign up for an account with your preferred payment gateway (e.g., Stripe, Authorize.Net, PayPal Pro).

- Locate API Keys: Within your gateway account settings, navigate to the section labeled “API Keys,” “Developer Settings,” or something similar. You’ll typically find both a test/sandbox key and a live key.

Install the WooCommerce Plugin

- WordPress Dashboard: In your WordPress admin area, go to “Plugins” -> “Add New.

- Search: Search for your gateway (e.g., “WooCommerce Stripe”) and install the official or a well-maintained plugin.

- Activate: Once installed, activate the plugin.

Configure Plugin Settings

- WooCommerce Settings: Navigate to “WooCommerce” -> “Settings” -> “Payments.”

- Locate Your Gateway: Your newly installed gateway will be listed. Click on it to access its configuration settings.

- Paste API Keys: Enter the API keys you obtained from your gateway account. Ensure you’re using the correct keys for either test/sandbox mode or live mode.

- Additional Settings: Configure options like accepted payment methods, currency support, customer email receipts, and any gateway-specific settings.

Thorough Testing

- Enable Test Mode: Most gateways offer a test mode. Enable this to avoid processing real payments during setup.

- Perform Test Transactions: Place test orders using gateway-provided test credit card numbers or your gateway’s developer tools.

- Verify Success: Check your gateway account to ensure test transactions were successful (and not actually charged).

Payment Gateway Testing

You would only launch a new product after testing it. The same goes for your payment gateway!

- Why Testing Matters: Thorough testing ensures a smooth customer experience and prevents lost sales due to unexpected errors.

- Test Mode: Always enable your payment gateway’s “test mode” or “sandbox mode” first. This allows you to simulate transactions without processing actual charges.

- Test Card Numbers: Payment gateways provide specific test credit card numbers and expiration dates to use during testing. Avoid using real customer data in this phase.

What to Test

Successful Transactions: Make sure payments of various amounts are processed correctly.

- Declined Transactions: Test how your store and the payment gateway handle declined payments. Do customers get clear error messages?

- Refunds: If your gateway supports refunds, initiate test refunds to verify the process works smoothly.

Involve a few testers (friends, colleagues) to simulate the customer experience from different perspectives.

Caution: Wait to switch your gateway to live mode until you’re confident that everything works as intended in testing!

Troubleshooting Common Issues

Even with careful setup, you might need help with your payment gateway. Here’s how to handle some common scenarios:

“Payment Declined” Errors

- Incorrect Card Details: Double-check that the customer has entered their card number, expiry date, and CVV correctly.

- Need for Funds: The customer may need to contact their bank.

- Gateway Settings: Ensure your gateway is configured to accept the card type and currency being used.

- Fraud Filters: Overly strict fraud detection settings might sometimes block legitimate transactions. Adjust these in your gateway’s settings if necessary, but do so cautiously.

Errors During Checkout

- API Key Mismatch: Verify that you’ve entered the correct API keys (live or test) in your WooCommerce settings.

- Connectivity Issues: Check if there are known outages with your payment gateway or your web hosting provider (Elementor Hosting boasts excellent uptime for reliability).

- Plugin Conflicts: Temporarily deactivate other plugins to rule out conflicts with your payment gateway plugin.

Unexpected Fees

- Hidden Gateway Fees: Review your payment gateway’s pricing structure carefully to make sure you understand all potential charges.

- Currency Conversion Fees: If you sell internationally, be aware of currency conversion fees charged by your gateway.

Missing Order Confirmations

- Email Settings: Ensure that both WooCommerce and your payment gateway are configured to send order confirmation emails correctly.

- Spam Filters: Check customers’ spam folders if they’re not receiving emails.

Troubleshooting Tips

- Gateway Logs: Most gateways offer detailed logs of transaction attempts. Check these for specific error codes or messages.

- Documentation: Refer to your gateway’s documentation for troubleshooting guides specific to their platform.

- Support Channels: Don’t hesitate to contact your payment gateway’s support team.

Optimizing Your WooCommerce Payment Experience

Enhancing Checkout Design

The way your checkout page looks and functions significantly impacts whether customers complete their purchase or abandon their cart. Here’s how to create a frictionless experience:

- Keep it Simple: Minimize the number of form fields and steps required. Ask for only the essential information to complete the order.

- Clear Progress Indicators: Show customers how many steps are in the checkout process and where they currently are.

- Guest Checkout: Allow customers to make purchases without creating an account. This reduces friction for new shoppers.

- Trust Signals: Display security badges (SSL, PCI compliance), customer testimonials, or guarantees prominently to build trust.

- Visually Appealing Design: Make sure your checkout page aligns with your overall website design for a cohesive experience.

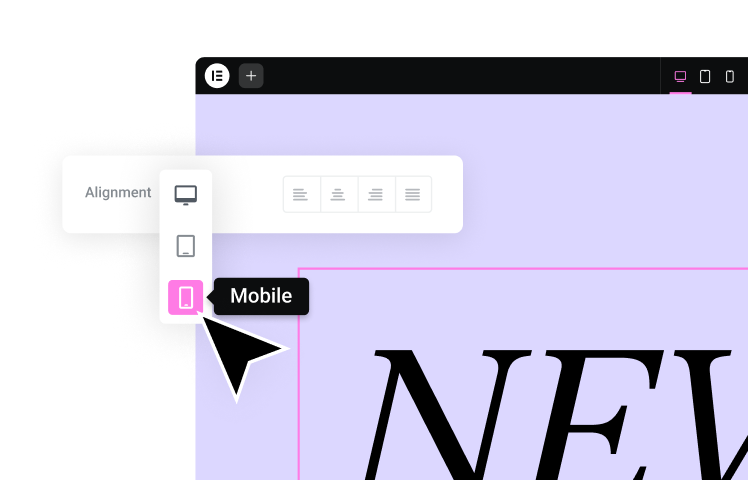

Tip: Elementor website builder gives you unparalleled control over checkout page customization. Use its drag-and-drop interface, dedicated checkout widgets, and theme builder capabilities to create a checkout flow that’s both smooth and visually appealing.

Additional Design Considerations:

- Error Messages: Use clear, helpful error messages to guide customers if they mistype their card numbers or enter an invalid expiry date.

- Autofill Support: Ensure your forms are compatible with browser autofill features to help customers complete their details quickly.

- Contact Information: Include an easy way for customers to contact you with questions (a visible support email or a live chat button can be reassuring).

Mobile Payments

With mobile shopping booming, a seamless mobile payment experience is non-negotiable. Here’s why it matters:

- M-commerce Growth: Mobile commerce sales are steadily increasing. Optimizing for mobile ensures you capture this growing market segment.

- User Expectations: Customers expect a smooth payment experience on all devices, regardless of screen size.

- Cart Abandonment: Clunky mobile checkout forms are a significant contributor to cart abandonment.

Mobile Payment Optimization

- Responsive Design: Your payment gateway and checkout pages must automatically adapt to smaller screens for optimal display.

- Mobile-Friendly Payment Methods: Support methods like Apple Pay, Google Pay, and PayPal, which offer one-click payments on mobile devices.

- Large, Clear Input Fields: Make it easy for customers to enter their payment details on touchscreens.

- Minimized Scrolling: Keep forms concise and avoid excessive scrolling on mobile devices.

- Testing on Mobile: Rigorously test your checkout process on different mobile devices and browsers to ensure a smooth experience.

Building a website with Elementor website builder gives you a head start on mobile responsiveness thanks to its mobile-first design tools. Couple that with a mobile-optimized payment gateway, and you’ll ensure a seamless experience for shoppers on the go.

Alternative Payment Methods

Expanding beyond traditional credit and debit cards can increase your conversion rates and cater to different customer preferences. Consider these options:

- Digital Wallets: PayPal, Apple Pay, Google Pay, and other digital wallets streamline the checkout process, especially on mobile devices.

- Buy Now, Pay Later (BNPL): Services like Klarna, Affirm, and Afterpay allow customers to split payments into installments, potentially attracting younger shoppers or those making larger purchases.

- Local/Regional Payment Methods: If you sell internationally, offer payment methods popular in specific regions (e.g., Alipay, iDEAL, Sofort). This shows localization and builds trust with customers.

- Cryptocurrency: While still niche, accepting cryptocurrency payments (e.g., Bitcoin) could attract a tech-savvy audience and position your store as forward-thinking.

Factors to Consider

- Target Audience: Research which alternative payment methods are popular with your customer demographics.

- Fees: Some alternative methods may have higher transaction fees than traditional credit cards.

- Setup Complexity: Integration and managing refunds can be more complex with certain payment methods.

- Customer Trust: Choose reputable providers for alternative payment options to reassure customers.

Caution: Don’t overwhelm customers with too many options. Offer a curated selection of the most relevant alternative methods for your target market.

Tip: Research plugins or extensions that add support for alternative payment methods to your WooCommerce store.

Speed and Performance Considerations

Slow loading times are challenging for customers; they directly impact your bottom line. Every second of delay matters, especially during the payment process.

Why Speed is Crucial

Impatience: In today’s fast-paced world, people don’t tolerate slow websites. Long load times lead to cart abandonment.

- Search Engine Rankings: Google factors site speed into its rankings, so a fast checkout positively impacts your SEO as well.

- Trust and Perception: A snappy payment process inspires confidence in your website’s security and professionalism.

How Payment Gateways Impact Speed:

- External Requests: Each payment gateway communicates with external servers, adding some processing time.

- Optimization: Well-optimized gateways minimize their impact on page load times. Choose providers with a focus on performance.

- Caching: Implement caching strategies (browser caching, object caching) to reduce data loading times on subsequent visits.

Elementor Hosting is built upon Google Cloud’s high-performance infrastructure, including its Cloudflare Enterprise CDN, for blazing-fast site speeds. This translates to a smoother, speedier payment process for your customers.

Fraud Prevention and Security Best Practices

Protecting sensitive customer data isn’t just about choosing a good payment gateway; it’s about your overall approach to security. Here’s your action plan:

PCI DSS Compliance

- The Standard: The Payment Card Industry Data Security Standard (PCI DSS) outlines security requirements for businesses handling credit card information.

- Your Responsibility: Ensure that your WooCommerce store, web hosting, and chosen payment gateway adhere to the latest PCI DSS guidelines.

- Self-Assessment or Audit: Depending on your transaction volume, you may need to complete an annual self-assessment questionnaire or undergo a formal audit by a Qualified Security Assessor (QSA).

SSL Certificates

- Encryption: An SSL (Secure Sockets Layer) certificate encrypts data transmitted between your customer’s browser and your website. Look for the padlock icon and “HTTPS” in the address bar.

- Trust Factor: SSL certificates reassure customers that their payment information is being handled securely.

Elementor Hosting includes a free SSL certificate for secure transactions right out of the box.

Strong Passwords & User Management

- Enforce Complexity: Require strong passwords for all accounts with access to your WooCommerce store’s admin panel.

- Limit Access: Restrict admin privileges to only those who absolutely need them.

- Two-Factor Authentication (2FA): Consider adding an extra layer of security with 2FA for logins to your store’s backend.

Proactive Security Measures

- Regular Updates: Keep WooCommerce, your theme, plugins, and your server software up to date to patch vulnerabilities quickly.

- Security Plugins: Consider a reputable WordPress security plugin (like Wordfence or Sucuri) for additional protection and monitoring.

- Firewalls: A web application firewall (WAF) can help block malicious traffic before it reaches your site.

- Security Audits: Schedule regular vulnerability scans or security audits to identify potential weaknesses.

Elementor Hosting customers benefit from multiple layers of security, including Cloudflare’s security features and built-in malware protection, offering robust protection for your store’s data.

Advanced Considerations & WooCommerce Extensions

Subscriptions and Recurring Payments

If your business model involves subscription services, memberships, or recurring billing, you’ll need to ensure your payment gateway and store are equipped to handle these types of transactions.

What to Look For:

- Subscription Functionality: Your chosen gateway must explicitly support recurring payments at various billing intervals (weekly, monthly, yearly, etc.).

- Automatic Billing: The gateway should handle the process of automatically charging customers on a recurring basis.

- Customer Management: Provide customers with an easy way to manage their subscriptions, update payment information, or cancel when needed.

Popular WooCommerce Subscription Plugins:

- WooCommerce Subscriptions: The official WooCommerce extension for robust subscription management.

- YITH WooCommerce Subscriptions: A powerful alternative with a wide range of features and customization options.

- Subscriptio: Another flexible subscription plugin that integrates with various payment gateways.

Tips for Subscription Success:

- Clear Pricing: Transparent pricing with different subscription tiers can appeal to a wider range of customers.

- Flexible Payment Gateways: If offering subscriptions, it’s wise to select a gateway that offers seamless integration with popular subscription plugins.

- Dunning Management: Look into gateways or plugins that help with dunning (automated retries for failed recurring payments) to reduce churn.

Payment Gateways for International Sales

Expanding your reach globally opens up a huge potential market but also introduces a layer of complexity when it comes to payments. Here’s what you need to consider:

- Multi-Currency Support: Does your payment gateway support the currencies of the countries you plan to sell in? Can it handle automatic currency conversions? Look for clear fee structures for currency exchange.

- International Taxes: Be aware of potential sales tax or VAT (Value-Added Tax) obligations in different countries, and ensure your checkout process can calculate and display these correctly.

- Regional Gateways: In some cases, using local payment gateways popular in specific regions can improve trust and conversion rates for customers in those areas. Research popular regional players.

- Language Localization: Translate your checkout pages and payment gateway interfaces into the languages of your target markets for a seamless customer experience.

Tips for International Success:

- Pricing Transparency: Clearly display prices in your customers’ local currencies and include any additional fees or taxes.

- Customer Support: Prepare to manage inquiries from international customers, potentially in different time zones.

- Shipping and Logistics: Before entering global sales, consider shipping costs, customs regulations, and reliable international shipping partners.

WooCommerce plugins can simplify international sales by handling currency conversions and tax calculations, as well as offering language translation for your checkout process.

Customizing the Payment Gateway Experience

While some gateways offer limited customization options, others provide more flexibility to tailor the look and flow of their payment forms. Here’s what to look for:

- Inline Forms: Some gateways allow embedding payment forms directly on your checkout page, creating a more integrated experience. This can be great for conversions!

- Branding and Styling: Check if the gateway allows you to adjust form colors, fonts, and logos to match your store’s branding.

- Custom Fields: If you need to collect additional information during checkout (beyond the standard fields), see if your gateway supports custom fields.

Caution: Avoid over-customizing your payment forms to the point where they become unrecognizable or untrustworthy. Strike a balance between branding and maintaining a familiar payment experience.

Conclusion

This ultimate guide to WooCommerce payment gateways covers a lot of ground. Choosing the right payment gateway isn’t just about features and fees—it’s a strategic decision that directly impacts your store’s conversion rates, security, and overall customer experience.

Originally posted 2023-03-19 16:28:00.

Looking for fresh content?

By entering your email, you agree to receive Elementor emails, including marketing emails,

and agree to our Terms & Conditions and Privacy Policy.