Table of Contents

But what if there was a simple, effective way to take control of your finances? A method that could help you cover your essentials, enjoy life, and build a secure future – all without needing a degree in accounting?

Enter the 60/30/10 budgeting rule. This straightforward approach to money management could be the game-changer you’ve been looking for. It’s a powerful tool that can help you organize your finances, reduce stress, and set yourself up for long-term success – both personally and professionally.

In this comprehensive guide, we’ll explore the 60/30/10 rule and show you how to adapt it to your unique situation as a digital professional. So, are you ready to take charge of your financial future? Let’s get started!

Understanding the 60/30/10 Rule

What Is the 60/30/10 Rule?

The 60/30/10 rule is a straightforward budgeting method that divides your after-tax income into three main categories:

- 60% for essential expenses

- 30% for discretionary spending

- 10% for savings and investments

This simple breakdown makes it easy to allocate your income and ensure you’re covering all your financial bases.

Origins and Principles

While the exact origins of the 60/30/10 rule are unclear, it’s rooted in the principles of balanced money management and is a variation of other popular budgeting methods, like the 50/30/20 rule popularized by Senator Elizabeth Warren.

The key principle behind the 60/30/10 rule is balance. It aims to help you:

- Cover your essential needs

- Enjoy life in the present

- Plan for the future

All without feeling overly restricted or guilty about your spending.

Benefits of Structured Budgeting

Adopting a structured budgeting approach like the 60/30/10 rule can offer numerous benefits:

- Clarity: You’ll have a clear picture of where your money is going.

- Control: It helps you take charge of your spending and saving habits.

- Flexibility: The rule can be adapted to fit your unique financial situation.

- Goal-oriented: It encourages saving and investing for the future.

- Stress reduction: Knowing you have a plan can significantly reduce financial anxiety.

For digital professionals like website creators, having this financial structure can provide a solid foundation for both personal and business growth.

The 60% Category: Essential Expenses

Defining Essential Expenses

The largest chunk of your budget – 60% – goes towards essential expenses. But what exactly counts as “essential”?

Essential expenses are the non-negotiable costs you need to cover to maintain your basic standard of living. These typically include:

- Housing (rent or mortgage)

- Utilities

- Food

- Transportation

- Insurance

- Minimum debt payments

Typical Costs for Digital Professionals

As a website creator or digital entrepreneur, your essential expenses might include some unique items:

- Internet and phone bills: These are crucial tools for your work.

- Software subscriptions: Essential programs for web design, project management, etc.

- Professional insurance: Liability insurance or errors and omissions coverage.

- Health insurance: Especially important if you’re self-employed.

- Taxes: Remember to set aside money for estimated tax payments!

Optimizing Essential Expenses

While these costs are necessary, there’s often room for optimization. Here are some strategies:

- Review your subscriptions. Are you using all the software you’re paying for? If not, could you downgrade any plans?

- Shop around for insurance: Compare rates annually to ensure you’re getting the best deal.

- Reduce utility costs: Simple changes like using energy-efficient bulbs or adjusting your thermostat can add up.

- Consider your workspace: If you’re renting an office, could you work from home instead? Or vice versa – would a coworking space be more cost-effective than your home setup?

- Meal planning: Cut food costs by planning your meals and cooking at home more often.

Remember, every dollar you save on essentials is a dollar you can put toward your other financial goals!

The 30% Category: Discretionary Spending

Balancing Wants and Needs

The 30% allocated to discretionary spending is where you get to enjoy the fruits of your labor. This category covers non-essential expenses – the “wants” rather than the “needs.”

Common discretionary expenses include:

- Entertainment (movies, concerts, streaming services)

- Dining out

- Hobbies

- Clothes (beyond basic necessities)

- Travel

- Gifts

Budgeting for Professional Development

As a digital professional, it’s crucial to include professional development in your discretionary spending. This might cover:

- Online courses or workshops

- Conference attendance

- Books or educational materials

- Networking events

Investing in your skills can pay off in the long run, potentially increasing your earning power.

Entertainment and Personal Expenses

While it’s important to invest in yourself professionally, remember to allocate funds for personal enjoyment. A balanced life includes time for relaxation and fun!

Consider setting up sub-categories within your 30% to ensure you’re covering all bases. For example:

- 10% for professional development

- 10% for entertainment and dining out

- 10% for personal hobbies and self-care

Remember, the key is to find a balance that works for you. If you’re passionate about your work, you might allocate more towards professional development. If you’re in a high-stress period, you might prioritize self-care and relaxation.

Avoiding Overspending

While the 30% category offers more flexibility, it’s easy to overspend here. Some tips to keep your discretionary spending in check:

- Track your spending: Use a budgeting app to monitor where your money is going.

- Plan for big expenses: If you know you’ll be attending a conference, start saving for it in advance.

- Look for free or low-cost alternatives: Many professional development resources are available for free online.

- Use the “wait and see” approach: Before making a non-essential purchase, wait 24-48 hours. If you still want it after that time, go ahead.

- Reward yourself responsibly: Set financial goals and treat yourself when you achieve them – but keep the treats within your budget!

By managing your discretionary spending wisely, you can enjoy life now while still preparing for future success.

The 10% Category: Savings and Investments

Building an Emergency Fund

Establishing an emergency fund should be the first priority in your 10% savings category. This financial safety net can help you weather unexpected expenses or income fluctuations, which are common challenges for digital entrepreneurs.

Aim to save 3-6 months of essential expenses in your emergency fund. If you’re just starting out, set smaller milestones:

- Save $1,000 as quickly as possible

- Build up to 1 month of expenses

- Gradually increase to 3-6 months

Keep your emergency fund in a high-yield savings account that is easily accessible but separate from your everyday spending money.

Saving for Retirement

Even if retirement seems far off, it’s crucial to start saving early. The power of compound interest means that even small contributions can grow significantly over time.

Consider these retirement savings options:

- Individual Retirement Account (IRA): Traditional or Roth IRAs offer tax advantages for retirement savings.

- Solo 401(k): If you’re self-employed, this can be an excellent option for retirement savings.

- SEP IRA: Another good choice for self-employed individuals or small business owners.

Aim to increase your retirement contributions over time, especially as your income grows.

Investing in Your Business

As a digital professional, investing in your business can be a form of saving for the future. This might include:

- Upgrading your equipment

- Investing in advanced software or tools

- Marketing and advertising to grow your client base

- Hiring help to scale your business

Remember, these investments should come from your 10% savings category, not your essential expenses or discretionary spending.

Exploring Other Investment Options

Once you have an emergency fund and are contributing to retirement, consider exploring other investment options:

- Index funds: These offer a simple way to invest in a broad market segment.

- Real estate: This could be direct property investment or Real Estate Investment Trusts (REITs).

- Individual stocks: If you’re comfortable with higher risk and have done your research.

Always do thorough research or consult with a financial advisor before making investment decisions.

The Power of Automation

Automating your contributions can make saving and investing easier. Set up automatic transfers from your checking account to your savings and investment accounts each time you get paid.

This “pay yourself first” approach ensures you’re consistently working towards your financial goals.

Implementing the 60/30/10 Rule

Steps to Get Started

Ready to put the 60/30/10 rule into action? Here’s a step-by-step guide:

- Calculate your after-tax income: This is your starting point.

- List all your expenses: Go through your bank statements and credit card bills to get a complete picture.

- Categorize your expenses: Divide them into essential, discretionary, and savings/investments.

- Adjust your spending: If your current spending doesn’t align with the 60/30/10 breakdown, identify areas where you can cut back or reallocate.

- Set up separate accounts: Consider having different accounts for each category to make tracking easier.

- Automate your finances: Set up automatic transfers to your various accounts on payday.

- Review and adjust regularly: Your financial situation will change over time, so review your budget periodically and make adjustments as needed.

Tracking Expenses Effectively

Accurate expense tracking is crucial for successful budgeting. Here are some effective methods:

- Use a budgeting app: Apps like YNAB, Mint, or Personal Capital can automatically categorize your expenses and give you a real-time view of your budget.

- Spreadsheet tracking: If you prefer a more hands-on approach, set up a spreadsheet to manually track your income and expenses.

- Envelope system: For discretionary spending, consider using cash envelopes to help you stick to your budget.

- Regular check-ins: Set aside time each week to review your spending and ensure you’re staying on track.

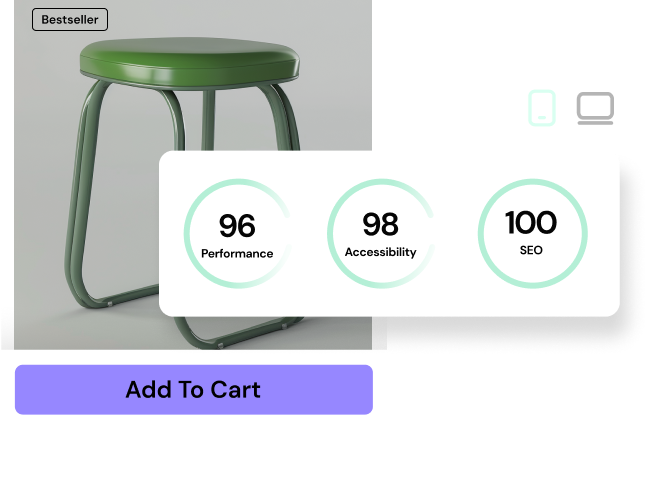

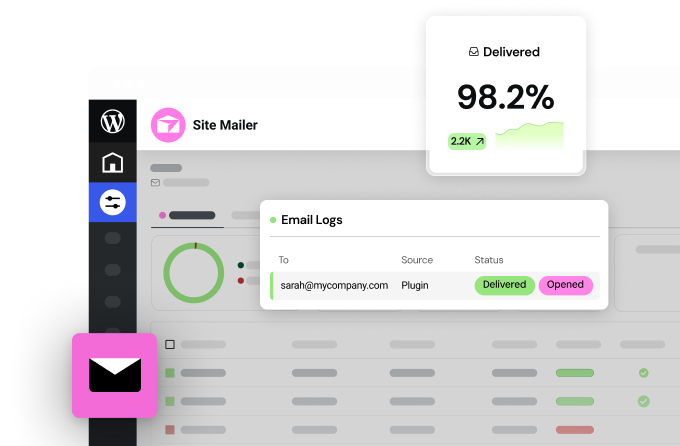

Budgeting Tools and Apps

While we’re on the topic of tools, it’s worth noting how the right technology can streamline not just your budgeting but your entire business operations. For instance, website builders like Elementor can significantly boost your efficiency, allowing you to create stunning websites quickly and easily. This efficiency can translate into more time for financial management and potentially increased income.

Some popular budgeting tools include:

- YNAB (You Need A Budget): Great for zero-based budgeting

- Mint: Free and user-friendly with automatic expense categorization

- Personal Capital: Offers budgeting tools along with investment tracking

- EveryDollar: Created by financial guru Dave Ramsey, good for beginners

Remember, the best tool is the one you’ll actually use consistently. Try out a few options to see what works best for you.

Adapting the 60/30/10 Rule for Digital Professionals

Handling Variable Income

One of the biggest challenges for many digital professionals is dealing with variable income. Here’s how to adapt the 60/30/10 rule to fit this scenario:

- Calculate your baseline: Determine the minimum amount you need to cover your essential expenses.

- Use percentages, not fixed amounts: Apply the 60/30/10 rule to whatever income you receive each month.

- Create a buffer: In high-income months, save extra in your “essential expenses” category to cover leaner months.

- Prioritize essentials: In low-income months, ensure you cover the 60% category first, then savings, and then discretionary spending.

- Average your income: If your income is wildly variable, consider using a 12-month average for budgeting purposes.

Budgeting for Business Expenses

As a digital entrepreneur, you’ll need to factor in business expenses. Here’s how to incorporate them into your 60/30/10 budget:

- Essential business expenses: Include these in your 60% category. This covers hosting fees, essential software subscriptions, or professional insurance.

- Discretionary business spending: Allocate part of your 30% category for non-essential business expenses like premium tools or additional training.

- Business savings: Consider setting aside part of your 10% savings for business emergencies or future investments.

Balancing Personal and Business Finances

Keeping your personal and business finances separate is crucial for both legal and organizational reasons. Here’s how to maintain this separation while still applying the 60/30/10 rule:

- Open separate accounts: Have dedicated business checking and savings accounts.

- Pay yourself a salary: Transfer a set amount regularly from your business account to your personal account. Apply the 60/30/10 rule to this “salary.”

- Reinvest in your business: Use a portion of your business income for growth and development, separate from your personal budget.

- Track business expenses separately: Use accounting software like QuickBooks or FreshBooks to keep clear records for tax purposes.

Remember, as your business grows, you may need to adjust your approach. Regular reviews of both your personal and business finances will help you stay on track.

Overcoming Budgeting Challenges

Dealing with Unexpected Expenses

Life has a way of throwing financial curveballs. Here’s how to handle unexpected expenses without derailing your budget:

- Use your emergency fund: This is exactly what it’s for! Just remember to replenish it afterward.

- Adjust your discretionary spending: Temporarily cut back on non-essentials to cover the unexpected cost.

- Look for additional income: Can you take on an extra project or sell something you no longer need?

- Avoid credit card debt: Don’t put unexpected expenses on credit cards unless you can pay them off immediately.

- Learn from the experience: Was this truly unexpected, or should you budget for similar expenses in the future?

Staying Motivated

Sticking to a budget long-term can be challenging. Here are some tips to stay motivated:

- Set clear financial goals: Having specific targets gives you something to work towards.

- Celebrate small wins: Acknowledge when you successfully stick to your budget or reach a savings milestone.

- Visualize your progress: Use charts or graphs to see how far you’ve come.

- Find an accountability partner: Share your goals with a friend or join a financial forum for support.

- Allow for occasional treats: Budget for small rewards to avoid feeling deprived.

Adjusting the Rule to Fit Your Needs

Remember, the 60/30/10 rule is a guideline, not a rigid law. Feel free to adjust the percentages to fit your situation better. For example:

- If you live in a high-cost area, you might need 70% for essentials and 20% for discretionary spending.

- If you’re aggressively saving for a big goal, you might allocate 15% or 20% to savings.

- In times of financial stress, you might temporarily shift to a 70/20/10 or even an 80/10/10 split.

The key is to find a balance that works for you while still covering your essentials, allowing for some enjoyment, and saving for the future.

Advanced Strategies

Accelerating Debt Payoff

If you’re carrying high-interest debt, consider modifying the 60/30/10 rule to prioritize debt repayment. Here’s how:

- Identify high-interest debt: Focus on paying off credit cards or personal loans with high interest rates first.

- Use the debt avalanche method: Pay minimum payments on all debts, then put extra money towards the highest-interest debt.

- Temporarily increase your “essentials” percentage: Consider allocating 70% to essentials and debt repayment, 20% to discretionary spending, and 10% to savings until high-interest debt is paid off.

- Look for ways to increase income: Use any extra earnings specifically for debt repayment.

Remember, becoming debt-free can significantly increase your financial flexibility in the long run.

Maximizing Savings and Investments

Once you’re comfortable with basic budgeting and have tackled any high-interest debt, consider these strategies to boost your savings and investments:

- Increase your savings rate gradually: Try to increase your savings percentage by 1% every few months.

- Take advantage of tax-advantaged accounts: Maximize contributions to IRAs, 401(k)s, or other retirement accounts.

- Consider a Health Savings Account (HSA): If eligible, an HSA can be a powerful tool for both healthcare costs and long-term savings.

- Explore passive income streams: Look for ways to generate income that don’t require constant active work, such as creating digital products or investing in dividend-paying stocks.

- Educate yourself: Continuously learn about personal finance and investing to make informed decisions.

Scaling Your Budget as Your Business Grows

As your digital business expands, your budget should evolve, too. Here’s how to scale your 60/30/10 rule:

- Reassess your essential expenses: As income increases, your 60% category might shrink proportionally. Don’t let lifestyle inflation eat up all your gains.

- Increase your savings rate: Try to allocate a larger percentage to savings and investments as your income grows.

- Invest in your business: Use part of your increased income to fuel business growth, potentially creating a virtuous cycle of increased earnings.

- Consider hiring help: As your business scales, it might make sense to outsource certain tasks. This could fall under your essential expenses.

- Plan for taxes: Higher income often means higher taxes. Ensure you’re setting aside enough to cover your tax obligations.

Remember, the goal is to improve your overall financial health while growing your business. Regularly review and adjust your budget to ensure it’s still serving your needs.

Conclusion

Mastering your finances is a crucial step in your journey as a digital professional. The 60/30/10 budgeting rule provides a flexible framework to help you achieve financial stability and growth. Let’s recap the key points:

- The 60/30/10 rule allocates 60% of your income to essentials, 30% to discretionary spending, and 10% to savings and investments.

- This rule can be adapted to fit the unique needs of digital professionals, including handling variable income and balancing personal and business finances.

- Implementing the rule involves tracking expenses, using budgeting tools, and regularly reviewing and adjusting your approach.

- Advanced strategies like accelerating debt payoff and maximizing savings can help you reach your financial goals faster.

Remember, the path to financial success is a marathon, not a sprint. Be patient with yourself as you implement these strategies, and celebrate your progress along the way.

As you continue to grow your digital business, tools like Elementor can help streamline your work processes, potentially freeing up more time and resources for financial management. Just as Elementor helps you build beautiful, functional websites efficiently, the 60/30/10 rule can help you build a strong, balanced financial foundation.

Take the first step today. Track your expenses and categorize them according to the 60/30/10 rule. Small changes can lead to big results over time. With persistence and smart financial habits, you’ll be well on your way to achieving both personal and professional financial success.

Your financial journey as a digital professional is unique, but you don’t have to navigate it alone. Engage with financial communities, seek advice when needed, and keep learning. Here’s to your financial success and the thriving digital business you’re building!

Looking for fresh content?

By entering your email, you agree to receive Elementor emails, including marketing emails,

and agree to our Terms & Conditions and Privacy Policy.