Gross to Net Salary Calculator

Your Salary Breakdown

Your Net Monthly Salary is

$0.00

The first step is to input your total gross earnings. This is the starting figure – the total amount you earn before any deductions. If you’re an employee, this would be your gross salary per period (e.g., monthly, bi-weekly, annually). If you're self-employed, it’s your total revenue for the period.

Be sure to enter the correct figure. Double-check your payslip or invoices to ensure accuracy. The precision of your input directly impacts the accuracy of the final net income calculation.

This is where you tell the calculator about the specific deductions that apply to you. Our calculator is designed to be flexible and accommodate various common deductions. You'll typically find fields to enter:

You can often choose to enter these as fixed amounts or percentages, depending on how your payroll or expenses are structured.

Once you’ve entered your gross income and all applicable deductions, simply click the ‘Calculate’ button. In an instant, our **Gross to Net Calculator** will display your estimated net income. You’ll see the breakdown of how your gross income has been reduced by each deduction, giving you a clear picture of what you’ll take home.

This final figure is your net income, the amount you can rely on for your personal finances. Use this information to inform your budgeting, saving, and spending decisions.

Navigating the world of personal finance can sometimes feel like deciphering an ancient script. You receive your payslip, or perhaps you’re self-employed and invoicing clients, and you see a figure – that’s your gross income. But what’s left after all the deductions? That’s your net income, the actual money you have available to spend, save, and invest. For many, the journey from understanding the difference to accurately calculating it can be a source of confusion and frustration. This is where a reliable Gross to Net Calculator becomes an invaluable tool.

On this page, we’re going to dive deep into the world of gross and net income. We’ll explain exactly what these terms mean, why the distinction is so important, and crucially, how our user-friendly Gross to Net Calculator can simplify this process for you. Whether you’re an employee receiving a regular salary, a freelancer managing your own business, or simply someone wanting a clearer picture of your financial health, this guide and our tool are designed to provide clarity and empower your financial decisions.

Let’s begin by understanding the foundation: gross income. In its simplest form, gross income is the total amount of money you earn before any deductions are taken out. For employees, this is typically your agreed-upon salary or hourly wage multiplied by the hours worked. For self-employed individuals or business owners, it’s the total revenue generated from sales, services, or projects, before any business expenses or taxes are accounted for.

It’s important to recognize that gross income isn’t the figure you’ll actually deposit into your bank account. It’s the ‘headline’ number, the starting point from which various essential contributions and withholdings are made. Understanding your gross income is vital because it’s the basis for calculating many other financial aspects, including tax liabilities, retirement contributions, and loan eligibility.

Think of your gross income as the whole pie. Before anyone takes a slice for taxes, insurance, or savings, this is the entire delicious dessert. While it represents your total earning potential, it’s not the amount you can immediately use for your everyday expenses or long-term goals.

Net income, often referred to as take-home pay, is the amount of money remaining after all applicable deductions have been subtracted from your gross income. This is the ‘real’ money you have available for your living expenses, discretionary spending, and savings. For employees, net income is what appears in your bank account after your employer has made all the necessary withholdings.

The deductions that reduce gross income to net income can vary significantly depending on your employment status, location, and individual circumstances. Common deductions include:

For the self-employed, the concept of net income is slightly different but equally important. After earning their gross revenue, they are responsible for paying their own income taxes, self-employment taxes (which cover Social Security and Medicare), health insurance, and any business-related expenses. The remaining amount after these payments is their net income, or profit.

Your net income is the slice of the pie you can actually eat. It’s the figure that directly impacts your ability to pay bills, save for a down payment, or enjoy a vacation. Monitoring and understanding your net income is crucial for effective budgeting and financial planning.

The ability to accurately convert gross income to net income is fundamental for sound financial management. Here’s why it matters:

Without a clear understanding of your net income, you might be making financial decisions based on inflated figures, leading to potential shortfalls and financial stress.

Understanding the nuances of gross to net calculations can be time-consuming and prone to errors if done manually. That’s where our specialized Gross to Net Calculator comes in. Designed with simplicity and accuracy in mind, our tool takes the complexity out of this essential financial task.

We’ve built this calculator to be intuitive and accessible, allowing anyone to quickly determine their take-home pay. Whether you’re an employee wrestling with a payslip or a freelancer trying to estimate your post-tax earnings, our Gross to Net Calculator is your go-to solution.

This isn’t just another generic calculator; it’s a tool that aims to demystify your earnings, giving you the confidence to manage your money effectively. We believe that everyone should have easy access to understand their financial situation, and our calculator is a testament to that belief.

We’ve designed our Gross to Net Calculator to be incredibly straightforward. You don’t need to be a financial wizard to use it. Follow these three simple steps:

The first step is to input your total gross earnings. This is the starting figure – the total amount you earn before any deductions. If you’re an employee, this would be your gross salary per period (e.g., monthly, bi-weekly, annually). If you’re self-employed, it’s your total revenue for the period. Be sure to enter the correct figure. Double-check your payslip or invoices to ensure accuracy. The precision of your input directly impacts the accuracy of the final net income calculation.

This is where you tell the calculator about the specific deductions that apply to you. Our calculator is designed to be flexible and accommodate various common deductions. You’ll typically find fields to enter:

You can often choose to enter these as fixed amounts or percentages, depending on how your payroll or expenses are structured.

Once you’ve entered your gross income and all applicable deductions, simply click the ‘Calculate’ button. In an instant, our Gross to Net Calculator will display your estimated net income. You’ll see the breakdown of how your gross income has been reduced by each deduction, giving you a clear picture of what you’ll take home. This final figure is your net income, the amount you can rely on for your personal finances. Use this information to inform your budgeting, saving, and spending decisions.

While our Gross to Net Calculator provides a solid estimate, it’s worth noting that your actual net income can be influenced by several external factors and nuances:

Our Gross to Net Calculator is a powerful tool for estimation and understanding, but for precise tax planning, especially for complex financial situations, consulting with a qualified tax advisor or accountant is always recommended.

The universality of earnings and expenses means our Gross to Net Calculator has broad appeal. Here are just a few groups who will find it particularly useful:

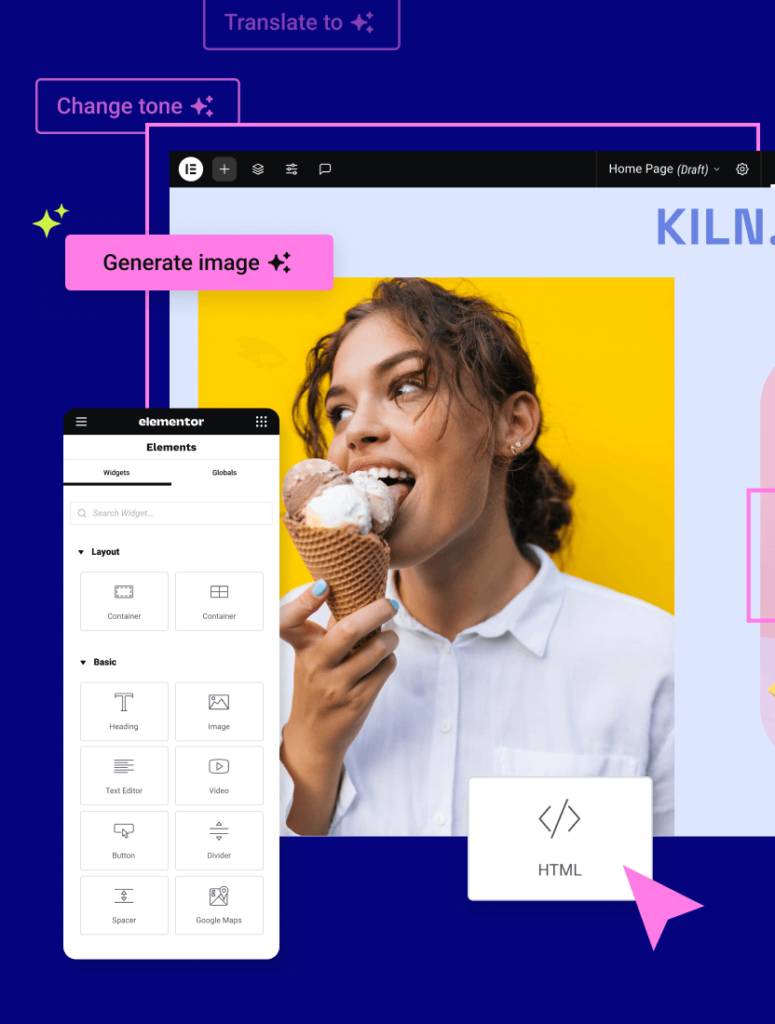

This Gross to Net Calculator is a prime example of how powerful and versatile web design can be, especially when utilizing a platform like Elementor. Elementor is a leading website builder for WordPress that empowers users to create stunning, professional websites without needing to code. Its intuitive drag-and-drop interface allows for incredible flexibility in designing pages, adding dynamic content, and integrating powerful tools.

For instance, if you’re building a website focused on financial services or personal finance advice, integrating a functional calculator like this enhances user experience significantly. You can customize the look and feel of the calculator to seamlessly match your website’s design, making it an integral part of your user journey. This level of customization is key to providing a valuable and branded experience for your visitors. Discover more about the possibilities with Elementor.

Elementor also offers a suite of tools that can complement your website’s functionality. Need to generate creative business names for your financial consulting firm? Check out the Elementor Business Name Generator. If you’re working with code snippets for your website, the Elementor HTML Viewer can be incredibly handy. For a truly cutting-edge experience, explore Elementor’s AI capabilities with Elementor AI. And for building an inclusive online presence, consider Elementor Ally for web accessibility. Even choosing the right hosting can impact your website’s performance, and Elementor offers solutions through Elementor Hosting.

Q1: What is the difference between gross and net pay? A1: Gross pay is your total income before any deductions are taken out. Net pay is the amount you actually receive after all taxes, insurance premiums, retirement contributions, and other deductions have been subtracted from your gross pay.

Q2: Why is my net pay always lower than my gross pay? A2: Your net pay is lower because various mandatory and voluntary deductions are taken from your gross pay. These typically include federal, state, and local income taxes, Social Security and Medicare taxes, health insurance premiums, and retirement contributions.

Q3: Can I use this calculator if I’m self-employed? A3: Yes! Our Gross to Net Calculator is highly beneficial for the self-employed. You can input your gross revenue and then deduct estimated taxes (income tax, self-employment tax), health insurance, and other business-related expenses to estimate your net income.

Q4: How accurate is the calculator? A4: Our calculator provides a very accurate estimate based on the information you input. However, tax laws and individual circumstances can be complex. For precise tax planning, especially for intricate financial situations, consulting a tax professional is always recommended.

Q5: What if my deductions change? A5: If your deductions change (e.g., you enroll in a new health plan, change your retirement contribution, or tax laws are updated), you will need to re-enter the updated deduction amounts into the calculator to get an accurate net income figure.

Q6: Does the calculator account for all possible deductions? A6: Our calculator includes fields for the most common deductions. If you have unique or less common deductions, you may need to adjust your calculations manually or seek professional advice. The goal is to provide a comprehensive yet user-friendly tool.

Understanding your earnings is the first step towards achieving financial peace of mind and reaching your financial goals. Our Gross to Net Calculator is designed to make this process as simple and transparent as possible. Don’t let confusing numbers hold you back; use our tool to gain clarity and make informed decisions about your money.

Whether you’re managing your first paycheck or your business’s entire revenue stream, knowledge is power. Empower yourself with accurate financial insights today by using our Gross to Net Calculator. Start calculating, start planning, and start building a more secure financial future.

Stop wasting time optimizing images by hand. Our plugin does it automatically, making your site faster and freeing you up to focus on what matters most.