Cap Rate Calculator

Capitalization Rate

0.00%

0.00%

The first crucial piece of information you need is the property's Net Operating Income (NOI). This is the annual income generated by the property after deducting all operating expenses, but before accounting for mortgage payments, depreciation, and income taxes. To calculate your NOI, you'll typically sum up all rental income, plus any other income streams (like parking fees, laundry revenue, etc.), and then subtract all operating expenses. These expenses include property taxes, insurance, property management fees, repairs and maintenance, utilities (if paid by the owner), and administrative costs. It's important to be thorough and accurate when calculating your NOI, as this directly impacts the Cap Rate result.

Example: If a commercial property generates $100,000 in annual rental income and has $30,000 in annual operating expenses, its NOI would be $70,000.

Our calculator provides a clear field for you to enter this vital figure. Simply type in the total annual NOI for the property you are evaluating.

The second essential input is the property's valuation. This can be its current market value – what you believe it's worth today based on comparable sales and market conditions – or its proposed purchase price. For investors looking to acquire a property, this will typically be the offer price. For existing property owners evaluating their current holdings, it will be the estimated market value. Accuracy here is key, as the denominator in the Cap Rate formula directly influences the final output. Understanding the current market and being realistic about valuation will lead to the most meaningful results.

Example: If the commercial property from the previous example is currently on the market for $800,000, you would enter $800,000 as the Property Value.

Our user-friendly interface ensures you can easily input this figure. Just type in the total value or price in the designated field.

Once you've entered both your NOI and the Property Value, simply click the "Calculate" button. Our **Cap Rate Calculator** will instantly display the Cap Rate as a percentage. This is your key indicator of the property's potential annual return, assuming no debt financing. For instance, using our example numbers (NOI of $70,000 and Property Value of $800,000), the calculation would be $70,000 / $800,000 = 0.0875, which translates to an 8.75% Cap Rate.

Interpretation: An 8.75% Cap Rate means that for every dollar invested in the property, you can expect to earn 8.75 cents in net operating income annually, before accounting for debt or taxes. You can then compare this 8.75% to the Cap Rates of other similar properties in the area, or to your personal investment goals and risk tolerance. For instance, if similar properties are averaging a 7% Cap Rate, this property might be considered a more attractive investment. If the average is 9%, it might be priced too high or require further due diligence.

Are you a savvy real estate investor looking to make informed decisions about your next property purchase? Or perhaps a curious newcomer to the world of commercial real estate, eager to understand the fundamental metrics that drive profitability? Look no further. Our advanced **Cap Rate Calculator** is an indispensable tool designed to empower you with instant, accurate insights into the potential return on investment for any income-generating property. Built with the flexibility and user-friendliness you expect from a platform like Elementor, this calculator is more than just a numbers cruncher; it’s your gateway to smarter, more profitable real estate ventures.

In the dynamic and often complex landscape of real estate, understanding key financial indicators is paramount. The Capitalization Rate, or Cap Rate, stands out as one of the most crucial metrics for evaluating the profitability of income-producing properties. It provides a quick, standardized way to compare the potential returns of different investment opportunities, allowing you to assess their relative value and make data-driven decisions. Whether you’re a seasoned investor eyeing a multi-family dwelling, a retail space, or an office building, or a developer seeking to gauge the viability of a new project, our **Cap Rate Calculator** will be your trusted companion.

Before diving into how to use our powerful tool, let’s solidify your understanding of what a Cap Rate actually represents. The Cap Rate is a ratio used by real estate investors to estimate the potential return on a property. It’s calculated by dividing the Net Operating Income (NOI) of a property by its current market value or purchase price. Essentially, it tells you what percentage of the property’s value is generated by its annual income, before considering financing costs (like mortgage payments) or depreciation.

The formula is straightforward:

Cap Rate = Net Operating Income (NOI) / Property Value

A higher Cap Rate generally indicates a more attractive investment, suggesting a greater potential return on your capital. Conversely, a lower Cap Rate might signal a less profitable investment, or it could indicate a property in a prime location with strong potential for appreciation, where investors are willing to accept a lower immediate yield for future gains. It’s a vital tool for both buyers and sellers to establish a common ground for valuation and negotiation.

The significance of the Cap Rate in real estate investment cannot be overstated. Here’s why it should be a cornerstone of your investment strategy:

We’ve designed our **Cap Rate Calculator** to be intuitive and efficient, allowing you to get the insights you need without any complex setup. Whether you’re a seasoned pro or just starting, the process is remarkably simple. Here’s how to unlock its power:

The first crucial piece of information you need is the property’s Net Operating Income (NOI). This is the annual income generated by the property after deducting all operating expenses, but before accounting for mortgage payments, depreciation, and income taxes. To calculate your NOI, you’ll typically sum up all rental income, plus any other income streams (like parking fees, laundry revenue, etc.), and then subtract all operating expenses. These expenses include property taxes, insurance, property management fees, repairs and maintenance, utilities (if paid by the owner), and administrative costs. It’s important to be thorough and accurate when calculating your NOI, as this directly impacts the Cap Rate result.

Example: If a commercial property generates $100,000 in annual rental income and has $30,000 in annual operating expenses, its NOI would be $70,000.

Our calculator provides a clear field for you to enter this vital figure. Simply type in the total annual NOI for the property you are evaluating.

The second essential input is the property’s valuation. This can be its current market value – what you believe it’s worth today based on comparable sales and market conditions – or its proposed purchase price. For investors looking to acquire a property, this will typically be the offer price. For existing property owners evaluating their current holdings, it will be the estimated market value. Accuracy here is key, as the denominator in the Cap Rate formula directly influences the final output. Understanding the current market and being realistic about valuation will lead to the most meaningful results.

Example: If the commercial property from the previous example is currently on the market for $800,000, you would enter $800,000 as the Property Value.

Our user-friendly interface ensures you can easily input this figure. Just type in the total value or price in the designated field.

Once you’ve entered both your NOI and the Property Value, simply click the “Calculate” button. Our **Cap Rate Calculator** will instantly display the Cap Rate as a percentage. This is your key indicator of the property’s potential annual return, assuming no debt financing. For instance, using our example numbers (NOI of $70,000 and Property Value of $800,000), the calculation would be $70,000 / $800,000 = 0.0875, which translates to an 8.75% Cap Rate.

Interpretation: An 8.75% Cap Rate means that for every dollar invested in the property, you can expect to earn 8.75 cents in net operating income annually, before accounting for debt or taxes. You can then compare this 8.75% to the Cap Rates of other similar properties in the area, or to your personal investment goals and risk tolerance. For instance, if similar properties are averaging a 7% Cap Rate, this property might be considered a more attractive investment. If the average is 9%, it might be priced too high or require further due diligence.

Our calculator not only provides the number but also offers brief interpretive guidance to help you understand what that percentage means in the context of real estate investment. You can then use this information to refine your investment strategy, inform your negotiations, or simply gain a clearer picture of your current portfolio’s performance.

While the **Cap Rate Calculator** is an incredibly powerful tool, it’s crucial to remember that it’s just one piece of the real estate investment puzzle. A truly comprehensive investment analysis requires considering a multitude of other factors:

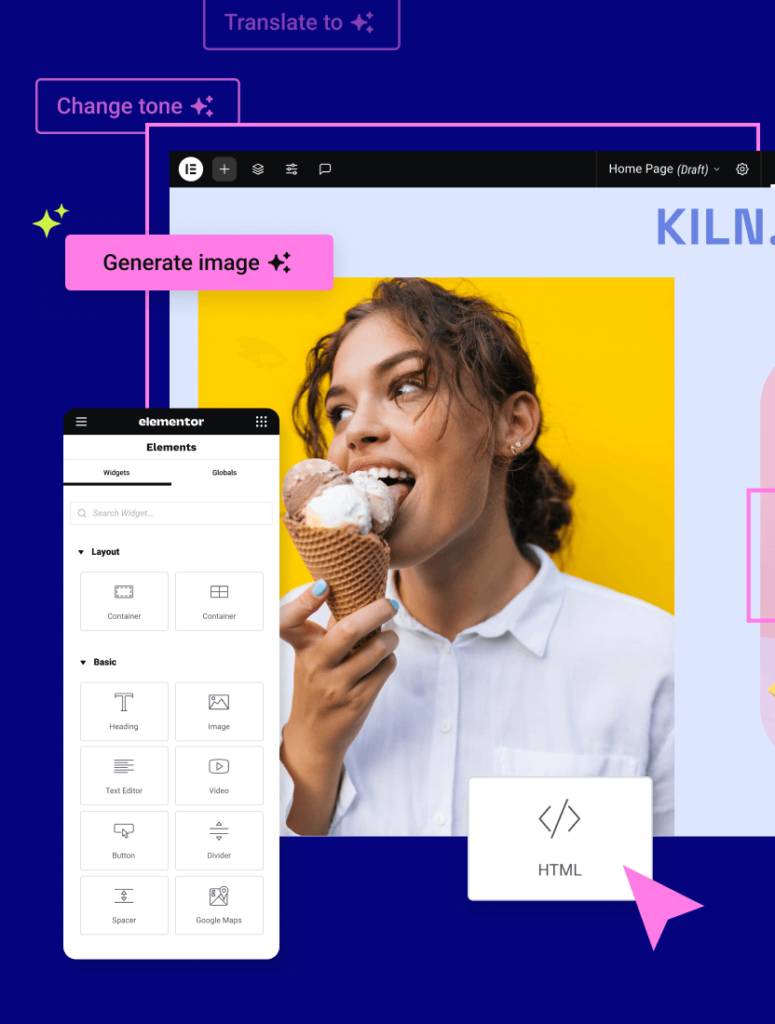

Our **Cap Rate Calculator** provides the foundational financial metric. For deeper dives into your investment strategy, consider exploring other tools that can help streamline your business operations. For example, if you’re launching a new venture and need a memorable name, our Business Name Generator can spark creativity. If you’re working with website code, the HTML Viewer is invaluable. For broader business growth and support, Elementor offers a suite of powerful solutions, including advanced AI tools like Elementor AI to enhance your content creation, and solutions for accessibility like Ally Web Accessibility to ensure your site is inclusive. And if you’re looking for a robust and reliable hosting solution, check out Elementor Hosting.

The **Cap Rate Calculator** is not just for initial property acquisition; it’s a dynamic tool for ongoing portfolio management. Regularly calculating and comparing Cap Rates for your existing properties allows you to:

Our **Cap Rate Calculator** is designed for a wide range of individuals and entities involved in real estate investment:

The world of real estate investment is built on a foundation of sound financial analysis. The **Cap Rate Calculator** is your essential starting point for understanding the potential returns of income-producing properties. By providing accurate inputs for Net Operating Income and Property Value, you can quickly generate a crucial metric that informs your investment decisions, facilitates comparisons, and aids in negotiations. Remember to always consider the Cap Rate in conjunction with other market indicators and your personal investment goals to achieve the best possible outcomes.

Leverage our **Cap Rate Calculator** today and take a significant step towards smarter, more profitable real estate investing. It’s a free, easy-to-use tool that puts powerful financial analysis at your fingertips, empowering you to navigate the real estate market with confidence.

Stop wasting time optimizing images by hand. Our plugin does it automatically, making your site faster and freeing you up to focus on what matters most.