VAT payments

In accordance with tax authorities, Elementor adds VAT to the price of your purchase. The VAT rate charged is calculated according to your country’s regulations as determined by your billing address. Please make sure your billing information is correct.

We currently charge VAT for the following locations:

- Israel

- European Union

Deducting VAT payments

Eligible businesses in the EU can deduct VAT payments from their purchases. To deduct VAT, fill in your VAT number when you make your purchase.

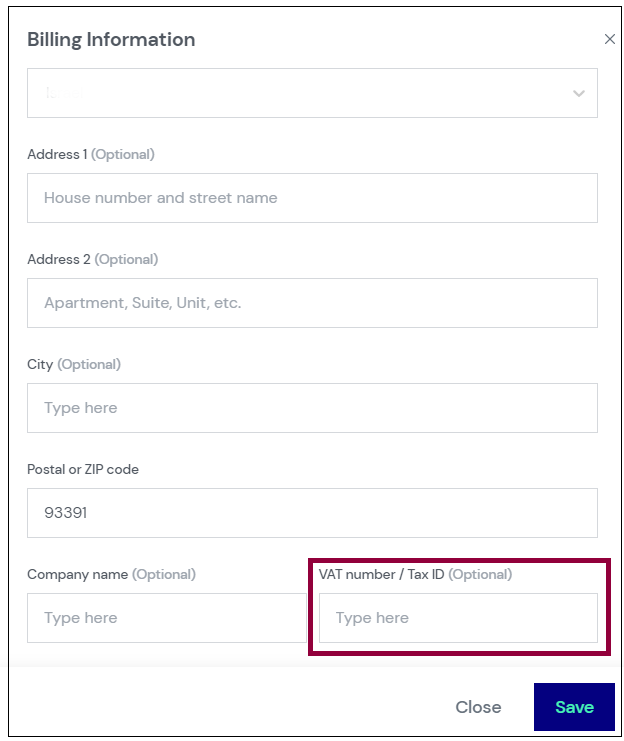

You must enter your VAT number when you make your purchase in order to deduct the VAT. For future billing of existing subscriptions (such as renewals), you can also update your VAT number at the subscription level through your My Elementor Dashboard.. If you have more than one subscription, you’ll need to add your VAT number to each subscription.

To enter your VAT number through the My Elementor Dashboard:

- Go to the Billing tab or your My Elementor Dashboard.

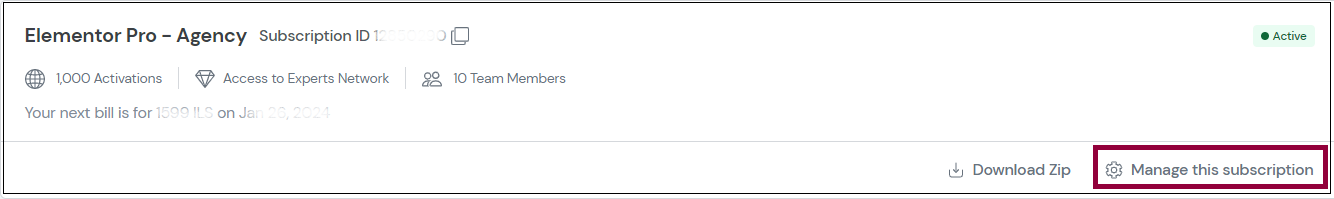

- Select Manage this subscription for the relevant subscription.

- Click the edit billing address icon.

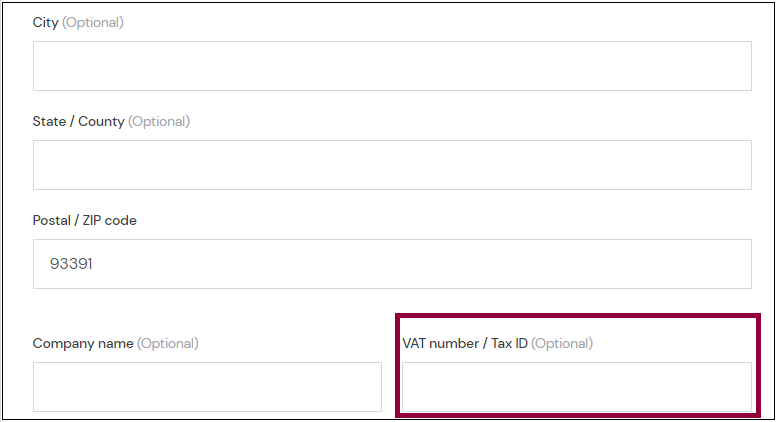

- Enter your VAT number in the appropriate field.NoteVAT deductions are validated through the VIES system. If the system does not recognize the number as valid, you will receive an error message.NoteYou’ll receive notification of any VAT charges in your auto-renewal notifications.

This VAT number will be used when renewing your subscription.

FAQ

Why do I have to pay VAT now when I didn’t before?

According to EU VAT directives (Articles 358a to 369 Directive 2006/112/EC), Elementor is obliged to collect VAT for services purchased by users established in European countries. We have updated our tax compliance according to these new regulations.

Am I eligible for an EU VAT exemption?

You can check with the VIES system to see if you have a valid VAT exemption.

The VAT is based on product cost with the rate dependent on the country of your billing address. This amount is added separately from the product cost. When buying an item that costs $X, you will see a total of $X during checkout, with the VAT listed separately.

When a valid VAT number is added in checkout, or in subscription billing information, no VAT will be added to the total charge.

Are you going to charge me for previous years?

No! You will not be charged VAT for previous years. The VAT will be added only for purchases made after the new policy updates.

Next Steps

To get the most out of Elementor, check out the Elementor Academy and our YouTube channel for helpful learning resources. If you come across any issues or need help, please contact our Support Center.