Table of Contents

Why Business Type Matters

Picking the right business structure is crucial. It affects how much you pay in taxes, your personal risk if the business fails, and how you can grow your company.

We’ll look at 13 common business types and what to think about when choosing one. Whether you’re new to business or have years of experience, this guide will help you make smart choices.

Grow Your Sales

- Incredibly Fast Store

- Sales Optimization

- Enterprise-Grade Security

- 24/7 Expert Service

- Incredibly Fast Store

- Sales Optimization

- Enterprise-Grade Security

- 24/7 Expert Service

- Prompt your Code & Add Custom Code, HTML, or CSS with ease

- Generate or edit with AI for Tailored Images

- Use Copilot for predictive stylized container layouts

- Prompt your Code & Add Custom Code, HTML, or CSS with ease

- Generate or edit with AI for Tailored Images

- Use Copilot for predictive stylized container layouts

- Craft or Translate Content at Lightning Speed

Top-Performing Website

- Super-Fast Websites

- Enterprise-Grade Security

- Any Site, Every Business

- 24/7 Expert Service

Top-Performing Website

- Super-Fast Websites

- Enterprise-Grade Security

- Any Site, Every Business

- 24/7 Expert Service

- Drag & Drop Website Builder, No Code Required

- Over 100 Widgets, for Every Purpose

- Professional Design Features for Pixel Perfect Design

- Drag & Drop Website Builder, No Code Required

- Over 100 Widgets, for Every Purpose

- Professional Design Features for Pixel Perfect Design

- Marketing & eCommerce Features to Increase Conversion

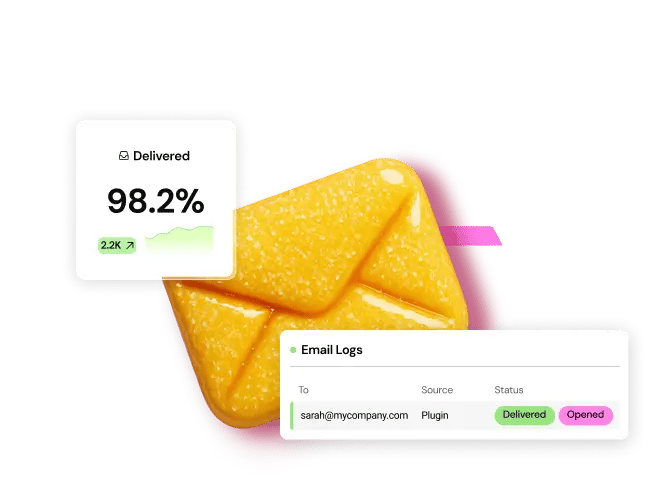

- Ensure Reliable Email Delivery for Your Website

- Simple Setup, No SMTP Configuration Needed

- Centralized Email Insights for Better Tracking

- Ensure Reliable Email Delivery for Your Website

- Simple Setup, No SMTP Configuration Needed

- Centralized Email Insights for Better Tracking

- Ensure Reliable Email Delivery for Your Website

- Simple Setup, No SMTP Configuration Needed

- Centralized Email Insights for Better Tracking

Common Business Structures

Let’s look at seven main types of businesses. Each has its own good and bad points.

1. Sole Proprietorship

This is the simplest business type. One person owns and runs everything. It’s easy to set up, which is why many freelancers and small business owners choose it.

You get to keep all the profits, but you’re also personally responsible for all debts. This can make it harder to get loans.

2. Partnership

A partnership is when two or more people run a business together. There are two main types: general partnerships, where all partners share management and responsibility, and limited partnerships, where some partners have less say and less risk.

Partnerships let you combine skills and resources and share the workload. But there’s also potential for disagreements, and partners share liability for debts.

Did you know? Sole proprietorships are the most common business type in many countries. This is likely because they’re so easy to start.

3. Limited Liability Company (LLC)

An LLC mixes features of sole proprietorships, partnerships, and corporations. It protects your personal assets if the business gets sued or goes into debt.

LLCs offer flexible tax options, which is a big plus. However, they require more paperwork than a sole proprietorship and can be more expensive to set up.

4. Corporation

A corporation is a separate legal entity from its owners. This gives the strongest protection for personal assets. There are different types, like S corporations and C corporations, each with its own tax rules.

Corporations find it easier to raise money by selling stock, but they’re more complex to run and may face double taxation in some cases.

5. Franchise

When you buy a franchise, you run a business using someone else’s brand and business model. Think of fast-food chains or some retail stores.

You get to use a known brand and often get help with marketing and operations. The downside is that you have less freedom to make changes and have to share profits with the franchise owner.

6. Cooperative

In a cooperative, the people who use the business (or work there) own and control it. Each member gets one vote, no matter how much they’ve invested.

This leads to democratic decision-making and shared ownership. However, cooperatives can be slower in making decisions, and profits must be shared among all members.

7. Non-profit

Non-profits work to help people or causes, not to make money. They don’t pay income tax and often rely on donations. Examples include the Red Cross and local animal shelters.

Non-profits enjoy tax benefits and can focus on helping others, but they have to follow strict rules, and it can be hard to get funding.

8. Joint Venture

A joint venture is when two or more businesses work together on a project. It’s like a short-term partnership. You can share risks and rewards and use each other’s strengths. However, joint ventures can be complex to set up and may lead to disagreements.

9. Holding Company

A holding company owns other companies. It doesn’t make things or provide services itself. It just controls other businesses. This setup can reduce risk and may have tax benefits. However, it’s a complex structure with strict rules to follow.

10. Subsidiary

A subsidiary is a company owned by another company (called the parent company). The parent company usually owns most of the subsidiary. Subsidiaries can operate independently and get support from the parent company. However, they have less control over big decisions and may have to share profits with the parent company.

11. Private Company

A private company is not listed on the stock market. A small bunch of folks run the company. This means they have more say in how things are done and don’t have to deal with a lot of red tape. But it can be tricky to get funding, and sometimes the owners can’t agree on which way to take the company.

12. Public Company

A public company sells its shares on the stock market. Anyone can buy a part of the company. This means they can raise lots of money, and shares can be easily bought and sold. However, public companies have lots of rules to follow, and the founders have less control.

13. Government Agency

A government agency is part of the government. It provides services or enforces rules. Examples include the Environmental Protection Agency (EPA) and the Social Security Administration. Government agencies have stable funding from taxes and work for public benefit. But they can be slow to change and may face political pressure.

Factors to Consider When Choosing a Business Type

Now that you know about different business types, let’s consider what to consider when picking one. Your choice matters a lot, so consider these factors carefully.

Your Personal Goals

Think about what you want to achieve. Do you want to make a lot of money? Help your community? Be creative. Maybe all of these? Your goals should guide your choice. For example, if you want to help people, a non-profit might be best for you.

Money Matters

How much money do you have to start? Different businesses need different amounts of money to get going. Think about how you’ll get money to start, whether from savings, loans, or investors.

Think about how much you need to start your business and how quickly you need to start making money. If you don’t have much cash, a sole proprietorship might be a good option. But if you need a lot of money, you might want to consider forming a corporation and finding investors.

How Much Risk Can You Handle?

Starting a business always has some risk. However, some business types are riskier than others. Ask yourself if you’re okay with possibly losing personal stuff if the business fails. Do you want to protect your personal assets? If you’re worried about risk, an LLC or corporation might be better than a sole proprietorship.

What Does the Market Want?

Is there a need for what you want to sell? Do some research to find out who might buy your product or service. What do they need and want? Are there already businesses doing what you want to do? This info will help you pick the right business type. For a small, specific market, a sole proprietorship or LLC might work. For a big market, you might need a corporation or franchise.

How Big Do You Want to Grow?

Think about your future plans. Do you want to stay small and local or grow into a big company? Some business types are better for staying small, while others make it easier to grow big. Corporations are good for big growth, while sole proprietorships often work better for smaller businesses.

Rules and Laws

Each business type has different rules to follow. Look into what paperwork you need to do, what taxes you’ll pay, and what licenses or permits you need. Make sure you understand these rules before you choose.

Your Lifestyle

How do you want to live and work? Think about whether you want flexible hours or if you want to work from anywhere. Do you prefer a more traditional work setup? If you want lots of freedom, a sole proprietorship might be good. If you like structure, a corporation or franchise could work better.

Bear in mind that as your business grows, you have the ability to modify its legal structure. Commence with the most suitable option for the present, while simultaneously considering your long-term aspirations.

Selecting an appropriate business entity is a significant decision. Allocate sufficient time for careful consideration. If you require assistance, consult with a legal professional or a certified public accountant. They possess the expertise to provide guidance tailored to the unique circumstances of your enterprise.

Through meticulous planning, you can establish a solid foundation for the success of your business. Extend my best wishes for the prosperous journey of your entrepreneurial endeavor.

Building Your Business Foundation: A Guide for New Entrepreneurs

You’ve picked your business type. Great! Now, it’s time to set up your business. Let’s go through the important steps.

1. Make a Business Plan

A business plan is like a map for your business. It shows where you want to go and how you’ll get there. Here’s what to put in it:

- Short summary: A quick look at your business and what you want to do.

- Company details: What you sell, who you sell to, and why you’re better than others.

- Market research: Info about your industry and who might buy from you.

- Who’s in charge: How is your business set up, and who does what?

- How you’ll sell: Your plan to find customers and make sales.

- Money stuff: How much money do you think you’ll make and spend?

Don’t worry if this seems hard. You can find free templates online to help you. The Small Business Administration (SBA) website has some good ones.

2. Follow the Rules

You need to make sure your business follows the law. This means:

- Signing up your business with the right people

- Getting any licenses you need

What you need to do depends on your business type and where you are. Make a list of what you need to do. You can find help on the SBA website or your state’s business office website.

3. Protect Your Ideas

Your business might have special things that make it unique. These could be:

- Your business name or logo (called a trademark)

- Something you invented (called a patent)

- Things you wrote or created (called a copyright)

It’s important to protect these. If you don’t, other people might copy them. If you’re not sure how to do this, talk to a lawyer who knows about business ideas.

4. Get Money to Start

Most businesses need money to get going. You have a few choices:

- Use your own savings

- Get a loan from a bank

- Find people who want to invest in your business

- Apply for free money (called grants) from the government or other groups

Think about what’s best for you. If you want people to invest, you’ll need to show them why your business is a good idea.

5. Make a Website

These days, most businesses need a website. It’s where people can learn about what you do. You can use a tool called Elementor to make a website. It’s easy to use – you don’t need to know how to code.

If you want to sell things online, Elementor works with another tool called WooCommerce, which allows you to set up an online store.

Elementor even has some AI features. These can help you make your website look good and work well.

Remember, starting a business takes time and work. But if you follow these steps, you’ll be off to a good start. Good luck!

Running Your Business: A Guide for New Entrepreneurs

You’ve set up your business. Great! Now, let’s talk about how to run it well.

Marketing: Getting People to Know You

Marketing is how you tell people about what you sell. First, create a brand – that’s your business name, logo, and message. Make sure it fits your business well. Next, think about advertising. You can use social media, search engines, or even TV ads if you have the money.

Don’t forget to create good content. This could be blog posts, videos, or social media posts that help your customers. Speaking of social media, use it to talk to people. Platforms like Facebook or Instagram are great for this.

Sales: Getting People to Buy from You

Sales is about turning interested people into customers. Start by setting your prices. Think about your costs and what others charge for similar things. Then, choose how you’ll sell. Will you sell online, in stores, or directly to people?

Finding new customers is also important. Think about ways to attract new buyers and keep them coming back. For example, you could offer a discount for first-time buyers or start a loyalty program.

Running Your Business Well

Focus on a few key areas to keep your business running smoothly. If you make products, find the best way to do it. Keep track of your inventory—have enough products to sell, but not so many that they sit around.

It is crucial to get products to people on time. Make sure your delivery process works well. And always be nice to your customers. Good customer service can turn one-time buyers into loyal fans.

Using Technology to Help

Technology can make running your business easier. Look for software that can perform tasks automatically, like accounting or keeping track of customers. This will free up your time for other important work.

Incorporate the lessons learned from your data into your business strategy. Analyze customer and sales information to identify patterns and trends that can inform decision-making. Embrace technological advancements and consider adopting new technologies that can enhance product or service offerings.

Wrapping Up

Picking the right business type is just the start. To do well, you need to understand different business types, think carefully about what’s right for you, and plan well. Running a business is hard work, but it can be really rewarding. Keep learning and be ready to change when you need to.

Remember, tools like Elementor can help you build a great website and online store. Use them to help your business grow online.

The best business owners are passionate and care about their customers. Stay true to what you believe in, change when you need to, and always try to give your customers something valuable. If you do these things, you can build a business that makes money and makes you happy.

Good luck with your business!

Looking for fresh content?

By entering your email, you agree to receive Elementor emails, including marketing emails,

and agree to our Terms & Conditions and Privacy Policy.