Understanding the differences between these structures is vital. This choice impacts your liability, how you pay taxes, the paperwork you handle, and even how potential clients or partners perceive your business. This article will break down sole proprietorships and LLCs to help you choose the best fit for your venture.

What is a Sole Proprietorship?

Let’s start with the basics. A sole proprietorship is the simplest and most common way to structure a business.

Think of it this way: if you start doing business activities – like freelance web design, consulting, or selling crafts – and you don’t register as any other kind of business, you are automatically a sole proprietor. It’s that straightforward.

Key Characteristics of a Sole Proprietorship

- One Owner: Owned and operated by a single individual.

- No Legal Separation: Here’s the critical part – the law does not see the business as separate from you, the owner. Your business debts are your debts. Your business income is your income.

- Easy Setup: Often, no formal action is required to legally form a sole proprietorship beyond obtaining the necessary local licenses and permits.

Advantages of a Sole Proprietorship

Why do so many people start this way? It has some clear benefits, especially when you’re just getting started.

- Inexpensive and straightforward Setup: You generally don’t need to file complex forms or pay hefty fees to the state just to exist as a sole proprietorship. You may need a local business license or permit, depending on your industry and location, but that’s usually all for the basic structure. This low barrier to entry makes it incredibly appealing for new ventures.

- Minimal Paperwork: Compared to other structures, the ongoing administrative burden is light. You don’t have to file mandatory annual reports with the state (beyond license renewals) or meet complex internal record-keeping requirements imposed by corporate law.

- Pass-through taxation: This may sound technical, but it’s pretty simple. The business itself doesn’t pay income taxes. Instead, all the profits (or losses) “pass through” directly to your income tax return (specifically, Schedule C of Form 1040). You report the business income and expenses, and the net profit is taxed at your individual income tax rate. This avoids the “double taxation” that can sometimes occur with traditional corporations.

- Direct Control: You are the boss. Period. You make all the decisions without needing approval from partners, shareholders, or a board of directors. This total control allows for quick pivots and simple management.

Disadvantages of a Sole Proprietorship

While simplicity is attractive, it comes with significant drawbacks you need to understand.

- Unlimited Personal Liability: This is the most significant risk. Because there’s no legal distinction between you and the business, you are personally responsible for all business debts and obligations. If your business incurs debt that it can’t pay, creditors can pursue your personal assets, such as your savings account, car, or even your house. If someone sues your business (e.g., a client unhappy with your work, someone injured on your business property), your assets are on the line. This lack of protection is a significant concern for many business owners.

- Difficulty Raising Capital: Sole proprietorships often struggle to attract investors or secure bank loans. Investors typically prefer structures like LLCs or corporations that offer ownership shares and limited liability. Banks might also perceive sole proprietorships as riskier due to the lack of legal separation and the potential instability that could result if something happens to the owner.

- Limited Lifespan: The business’s existence is tied directly to you. If you retire, become incapacitated, or pass away, the sole proprietorship typically ceases to exist. There isn’t a separate legal entity that can continue operating independently.

- Credibility Concerns: Some potential clients, especially larger companies or government agencies, might perceive a sole proprietorship as less professional or stable compared to an LLC or corporation. Using “Inc.” or “LLC” after your business name can add a layer of perceived legitimacy.

Grow Your Sales

- Incredibly Fast Store

- Sales Optimization

- Enterprise-Grade Security

- 24/7 Expert Service

- Incredibly Fast Store

- Sales Optimization

- Enterprise-Grade Security

- 24/7 Expert Service

- Prompt your Code & Add Custom Code, HTML, or CSS with ease

- Generate or edit with AI for Tailored Images

- Use Copilot for predictive stylized container layouts

- Prompt your Code & Add Custom Code, HTML, or CSS with ease

- Generate or edit with AI for Tailored Images

- Use Copilot for predictive stylized container layouts

- Craft or Translate Content at Lightning Speed

Top-Performing Website

- Super-Fast Websites

- Enterprise-Grade Security

- Any Site, Every Business

- 24/7 Expert Service

Top-Performing Website

- Super-Fast Websites

- Enterprise-Grade Security

- Any Site, Every Business

- 24/7 Expert Service

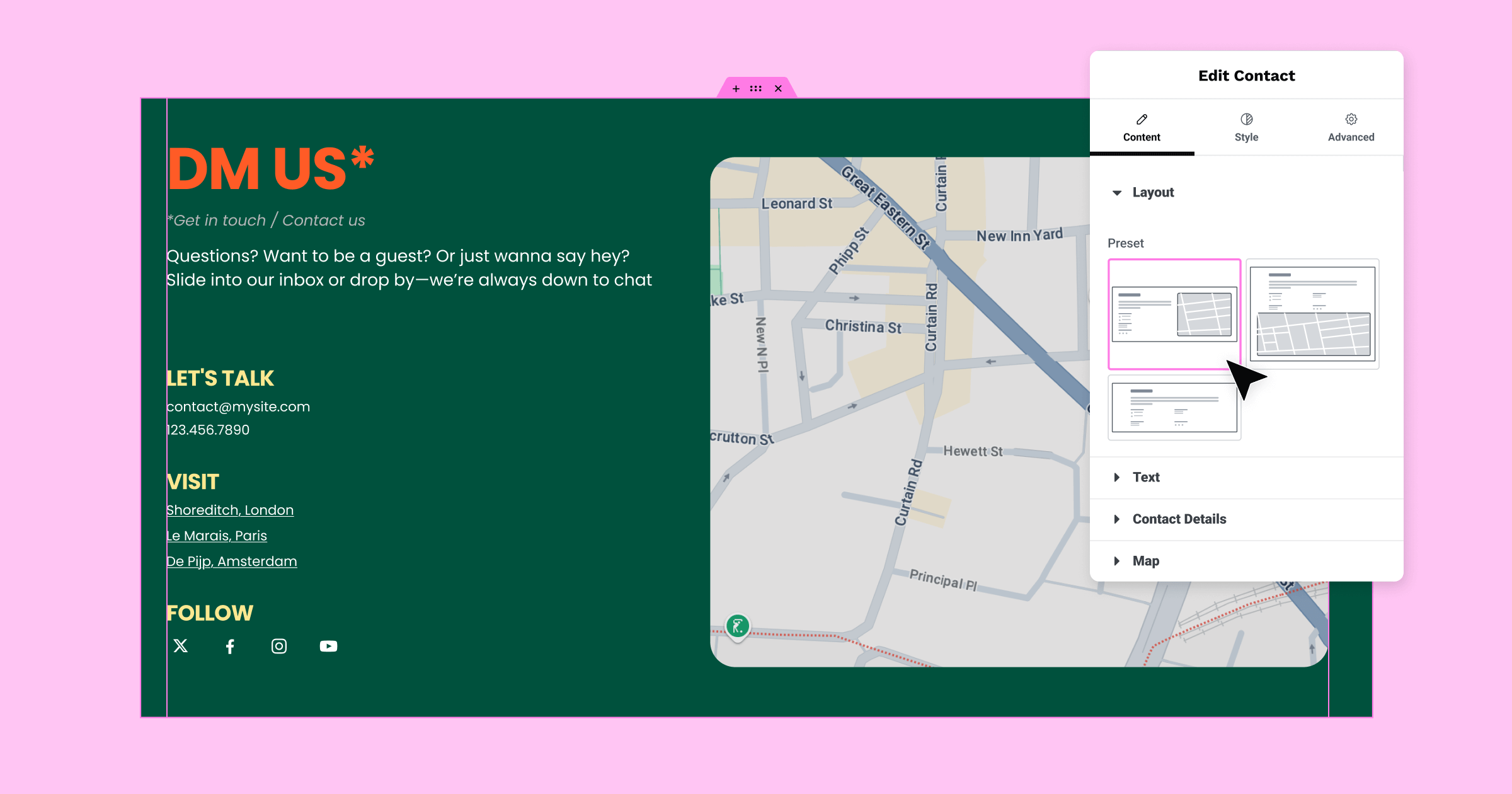

- Drag & Drop Website Builder, No Code Required

- Over 100 Widgets, for Every Purpose

- Professional Design Features for Pixel Perfect Design

- Drag & Drop Website Builder, No Code Required

- Over 100 Widgets, for Every Purpose

- Professional Design Features for Pixel Perfect Design

- Marketing & eCommerce Features to Increase Conversion

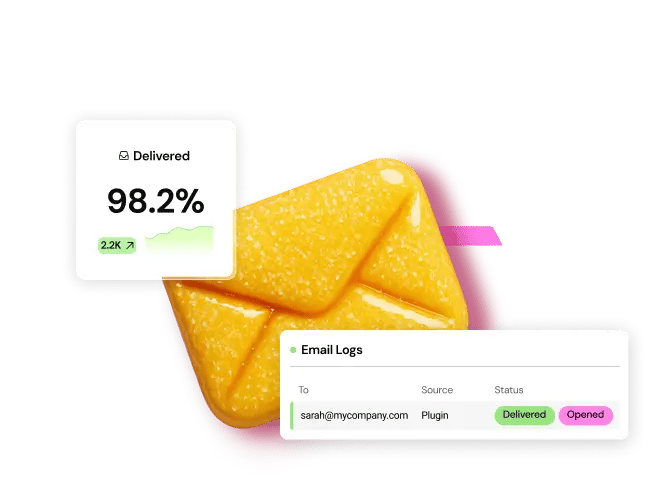

- Ensure Reliable Email Delivery for Your Website

- Simple Setup, No SMTP Configuration Needed

- Centralized Email Insights for Better Tracking

- Ensure Reliable Email Delivery for Your Website

- Simple Setup, No SMTP Configuration Needed

- Centralized Email Insights for Better Tracking

- Ensure Reliable Email Delivery for Your Website

- Simple Setup, No SMTP Configuration Needed

- Centralized Email Insights for Better Tracking

What is an LLC?

Now, let’s look at the Limited Liability Company (LLC). An LLC is a formal business structure registered with the state.

Think of an LLC as a hybrid. It blends characteristics of simpler structures, such as sole proprietorships or partnerships, with features of more complex corporations. Its primary purpose? To provide liability protection to its owners.

Key Characteristics of an LLC

- Legal Entity: An LLC is a legally separate entity from its owners, who are referred to as “members.” This separation is the foundation of its liability protection.

- Owners are “Members”: An LLC can have one or more members. A single-member LLC has one owner, while a multi-member LLC has multiple owners.

- State Registration: You must file specific documents (usually called “Articles of Organization”) with your state’s business filing agency (often the Secretary of State) and pay a fee to form an LLC.

- Operating Agreement: While not always required by law (depending on the state), a well-drafted operating agreement is crucial, especially for multi-member LLCs. This internal document outlines how the LLC will be managed, how profits and losses are distributed, and ownership rules.

Advantages of an LLC

Why go through the extra steps to form an LLC? The benefits are significant, especially as your business grows or takes on more risk.

- Limited Liability: This is the star attraction. Because the LLC is a separate legal entity, it shields your assets from business debts and lawsuits. If the LLC owes money or gets sued, its assets are generally at risk. Your savings, car, and house are typically protected. This protection is invaluable for peace of mind and financial security. There are exceptions, such as personally guaranteeing a loan or acting fraudulently, but generally, the liability shield remains in place.

- Taxation Flexibility: By default, the IRS treats LLCs similarly to sole proprietorships (for single-member LLCs) or partnerships (for multi-member LLCs) for tax purposes, meaning pass-through taxation. However, LLCs often have the option to elect to be taxed as a C corporation or an S corporation, which may offer tax advantages in their specific situation. This flexibility can be beneficial as the business grows and its financial picture changes.

- Enhanced Credibility and Professionalism: Having “LLC” after your business name often signals a higher level of seriousness and permanence to clients, suppliers, and partners. It shows you’ve taken formal steps to establish your business, which can boost trust and confidence.

- Easier to Raise Capital (than Sole Proprietorship): While not as straightforward as selling stock in a corporation, an LLC structure is generally more attractive to investors and lenders than a sole proprietorship. The limited liability protection and formal structure offer more security. LLCs can also define different classes of membership interests, which can facilitate investment.

Disadvantages of an LLC

Forming and running an LLC isn’t quite as simple as operating as a sole proprietor.

- More Complex and Costly Setup: You need to file formation documents with the state and pay filing fees, which vary by state but can range from $50 to several hundred dollars. You might also incur costs for drafting an operating agreement or using a registered agent service.

- More Paperwork and Compliance: LLCs often face ongoing requirements, such as filing annual reports with the state and paying annual fees or franchise taxes. You also need to maintain a more precise separation between personal and business finances, such as having a dedicated business bank account, to preserve the liability shield. This concept is sometimes referred to as “piercing the corporate veil.” If you treat the LLC’s money as your personal piggy bank, a court might disregard the liability protection.

- Potential for Self-Employment Taxes: Like sole proprietors, LLC members who actively work in the business usually pay self-employment taxes (Social Security and Medicare) on their share of the profits. While LLCs offer the option to be taxed as an S-corp, which can sometimes reduce self-employment tax liability under specific circumstances, this adds another layer of complexity.

Key Differences: Sole Proprietorship vs. LLC

Okay, we’ve looked at each structure individually. Now, let’s put them side by side to highlight the crucial differences. Understanding these differences is key to making the right choice for your specific situation.

| Feature | Sole Proprietorship | LLC | Why it Matters |

| Liability | Unlimited personal liability | Limited liability (Owners’ assets protected) | This is often the deciding factor. Protects your finances if the business faces debts or lawsuits. |

| Taxation | Pass-through (Income/loss on personal return) | Default: Pass-through. Option: Elect C-corp or S-corp tax status. | LLC offers more flexibility, which might save money in certain situations, but a pass-through is simple for both. |

| Setup | Simple, often automatic, minimal cost | Requires state filing, filing fees, and is more complex | LLC requires more initial effort and expense. |

| Maintenance | Minimal ongoing paperwork (usually just licenses) | Requires annual reports, fees, and stricter record-keeping | LLC involves more administrative work and ongoing costs to stay compliant. |

| Complexity | Low | Moderate | Sole proprietorship is easier to manage on a day-to-day basis from an administrative standpoint. |

| Credibility | May be perceived as less formal/stable | Generally viewed as more professional and established | LLC designation can boost confidence with clients, suppliers, and lenders. |

| Raising Capital | Difficult (Relies on personal credit/assets) | Easier than sole prop (Structure is more investor-friendly) | LLC structure provides a more transparent framework for investment and offers lenders more security. |

| Lifespan | Tied directly to the owner | Separate legal entity; can continue after the owner leaves | LLC offers more business continuity. |

Liability: The Most Important Distinction

If you take only one thing away from this comparison, let it be the difference in liability.

With a sole proprietorship, there is no separation between your business and personal finances. Imagine this:

- You’re a freelance consultant. A client claims that your advice led to a significant financial loss and sues your business for damages exceeding the balance in your business’s bank account. Because you’re a sole proprietor, the lawsuit doesn’t stop at business assets; it can also come after your personal savings, car, and potentially even your home equity.

- You run a small catering business out of your home kitchen, if allowed. A customer gets severe food poisoning and sues. Again, as a sole proprietor, all your assets could be targeted to cover the judgment.

This unlimited personal liability is a substantial risk, especially in industries prone to lawsuits or if your business takes on significant debt.

Now, contrast that with an LLC. Forming an LLC creates that legal wall, the “liability shield.”

- If that same consultant operating as an LLC gets sued, the lawsuit is typically directed at the LLC itself. If the LLC doesn’t have enough assets to cover the judgment, the claimant generally cannot go after the owner’s assets. Your house, personal car, and savings are protected.

- The caterer operating as an LLC faces a similar situation. The lawsuit targets the LLC’s assets, including its business bank account and equipment. The owner’s finances remain separate and safe.

Why is this protection crucial? Business inherently involves risk. Contracts can go wrong, accidents can happen, and economic downturns can lead to debt. Limited liability ensures that a business failure or lawsuit doesn’t lead to personal financial ruin. It allows entrepreneurs to take calculated risks without risking everything – literally.

Of course, this shield isn’t absolute. You can lose liability protection if you:

- Personally guarantee a business loan, which is standard for new LLCs.

- Commit fraud or illegal acts.

- Fail to keep business and personal finances separate (known as “piercing the corporate veil”).

- Are personally negligent (e.g., a doctor committing malpractice – the LLC protects from business debts, but not necessarily personal professional negligence).

Despite these exceptions, the fundamental protection offered by an LLC is a decisive advantage over the sole proprietorship.

Taxation Considerations

Taxes are another area where these structures differ, though less dramatically at first glance than liability.

Pass-Through Taxation Explained

Both sole proprietorships and the default LLC structure use pass-through taxation. This means the business itself doesn’t file a separate income tax return, although it reports information. Instead, the business’s net income (or profit) or loss is calculated, and that amount is reported on the owner’s federal income tax return (Form 1040).

- Sole Proprietor: Reports business income and expenses on Schedule C (“Profit or Loss from Business”). The net profit (or loss) from Schedule C flows to your Form 1040 and is added to any other income you have. You pay income tax on the total amount at your tax rate.

- Single-Member LLC (Default): Treated exactly like a sole proprietorship by the IRS for income tax purposes. You file Schedule C just the same. The IRS calls this a “disregarded entity” – for income tax purposes, it is disregarded as separate from the owner.

- Multi-Member LLC (Default): Treated like a partnership by the IRS. The LLC files an informational return (Form 1065), but it doesn’t pay income tax itself. Each member receives a Schedule K-1 that shows their share of the LLC’s income, deductions, credits, and other items. Members report this information on their Form 1040 and pay tax at their rates.

Self-Employment Taxes

Regardless of whether you’re a sole proprietor or an active LLC member, you’ll likely have to pay self-employment taxes. This covers your contributions to Social Security and Medicare, similar to the FICA taxes withheld from an employee’s paycheck.

Currently, the self-employment tax rate is 15.3% on the first $168,600 (for 2024, this threshold adjusts annually) of net earnings from self-employment, plus 2.9% on incomes above that threshold. This consists of 12.4% for Social Security (up to the annual limit) and 2.9% for Medicare (with no limit). When you work for someone else, you split this cost with your employer (7.65% each). When you’re self-employed, you pay the whole amount yourself. However, you can deduct one-half of your self-employment taxes as an adjustment to income.

This applies to the net profit shown on your Schedule C (for sole proprietors and single-member LLCs) or your share of the LLC’s ordinary business income (for multi-member LLCs).

LLC Tax Flexibility: The S-Corp Election

Here’s where LLCs offer a potential advantage. An LLC can elect to be taxed differently, specifically as an S corporation (or even a C corporation, although this is less common for small businesses).

Why consider an S-corp election? It can reduce self-employment taxes under the right circumstances. Here’s how it works (simplified):

- The LLC elects S-corp status with the IRS (Form 2553).

- The owner(s) who work in the business become “employee-owners.”

- The LLC pays the owner-employee a reasonable salary for the work performed. Regular income tax and FICA taxes (split between the employee and the LLC) are paid on this salary.

- Any remaining profits can be distributed to the owner(s) as dividends. These dividends are subject to income tax but not self-employment tax.

If the business is profitable enough, paying yourself a reasonable salary and taking the rest as distributions could lead to significant savings on self-employment taxes compared to paying the 15.3% on all net profits (as you would in a default sole prop or LLC).

However, this adds complexity. You need to run payroll, determine a “reasonable salary” (which the IRS scrutinizes), and potentially face higher administrative costs. It’s not always beneficial, especially for businesses with lower profits.

Consult a Professional

Tax rules are complex and depend heavily on your specific income level, business expenses, state laws, and long-term goals. While pass-through taxation is simple initially, the potential benefits and complexities of an S-corp election mean you should always consult with a qualified tax advisor or CPA. They can analyze your situation and help you determine the most advantageous tax strategy.

Section Summary: Both structures typically use simple pass-through taxation initially, reporting business income on personal returns. Both usually require paying self-employment taxes. LLCs offer tax flexibility, notably the option to elect S-corp status, which may reduce self-employment taxes but adds complexity. Always seek professional tax advice.

Setup and Maintenance: Complexity and Costs

How easy is it to get started and keep each structure running? This is where the simplicity of the sole proprietorship shines, but the effort for an LLC might be well worth the benefits.

Setting Up a Sole Proprietorship

Getting started as a sole proprietor is usually very straightforward.

- Just Start Working: In many cases, you don’t need to file any specific formation documents with the state government just to be recognized as a sole proprietorship.

- Business Name (Optional): If you operate under your own legal name (e.g., “Jane Smith Consulting”), you typically don’t need to register it. If you want to use a fictitious name or “Doing Business As” (DBA) name (e.g., “Summit Web Design”), you’ll likely need to register that name with your state or local government. This involves filing a form and paying a small fee.

- Licenses and Permits: Depending on your industry, city, county, and state, you will likely need one or more business licenses or permits to operate legally. This applies regardless of your chosen business structure. Research requirements for your specific location and field (e.g., professional licenses, health permits, seller’s permits).

- Employer Identification Number (EIN): You don’t need an EIN from the IRS if you’re a sole proprietor with no employees and don’t file excise or pension plan tax returns. You can just use your personal Social Security Number (SSN) for business tax purposes. However, getting a free EIN from the IRS website is often a good idea. It can help separate business and personal finances (banks often require one to open a business account) and avoids giving out your SSN unnecessarily.

Costs: Generally very low. Potential costs include DBA registration fees and license/permit fees.

Forming an LLC

Forming an LLC involves more formal steps and costs. The exact process varies slightly by state, but generally includes:

- Choose a Business Name: Your LLC name must comply with state rules. It usually must include an LLC indicator (like “LLC,” “L.L.C.,” or “Limited Liability Company”) and be distinguishable from other registered business names in your state. You’ll need to check name availability with the state’s business filing agency.

- Appoint a Registered Agent: An LLC must have a registered agent – a person or service designated to receive official legal documents, such as lawsuit notices or state correspondence, on behalf of the LLC. The registered agent must have a physical street address in the state where the company is formed and be available during business hours. You can often be your registered agent if you meet the criteria, but using a third-party registered agent service is common for privacy and reliability.

- File Articles of Organization: This is the core formation document. You file it with your state’s business agency, usually the Secretary of State. It typically includes the LLC’s name, the registered agent’s information, the principal business address, and sometimes the names of the members or managers.

- Pay Filing Fee: States charge a fee to file the Articles of Organization. This fee varies significantly, from around $50 to $500 or more, depending on the state.

- Create an Operating Agreement: While not always legally required by the state (especially for single-member LLCs), having an operating agreement is highly recommended. This internal document outlines ownership percentages, member responsibilities, profit and loss distribution, management structure, and procedures for adding or removing members, as well as dissolving the LLC. It helps prevent disputes and clarifies operations.

- Obtain an EIN: Most LLCs will need an EIN from the IRS, even single-member LLCs. You need it to open a business bank account, hire employees, and file certain tax forms, including an S-corp election. You can obtain an EIN for free on the IRS website.

- Licenses and Permits: Like sole proprietorships, LLCs must obtain all necessary federal, state, and local licenses and permits for their industry and location.

Costs: Higher than a sole proprietorship. Includes state filing fees, potential registered agent fees, and possibly fees for legal help with the operating agreement.

Ongoing Maintenance

- Sole Proprietorship: Minimal ongoing requirements beyond renewing licenses/permits and filing annual taxes (Schedule C). Record-keeping is essential for tax purposes, but it is less formalized.

- LLC: More demanding. Most states require LLCs to file an annual report and pay a yearly fee or franchise tax to remain in good standing. Failure to do so can result in penalties or even the administrative dissolution of the LLC, meaning you lose your liability protection. LLCs must also maintain strict separation between business and personal finances. This means having a dedicated business bank account, using business funds only for business expenses, and keeping clear financial records. This is crucial for preserving the liability shield.

Credibility and Raising Capital

Does your business structure affect how others see you? And can it impact your ability to grow? Often, yes.

Credibility and Professionalism

While many successful businesses operate as sole proprietorships, adding “LLC” or “Inc.” after your business name can subtly influence perception. Why might this be the case?

- Signal of Seriousness: Forming an LLC shows you’ve taken formal steps to establish your business legally. It suggests a level of commitment and planning that can instill confidence in potential clients, especially larger organizations or B2B customers.

- Implied Stability: The formal structure and separate legal identity of an LLC can mean greater stability and longevity compared to a business owned directly by an individual.

- Clearer Contracting: When contracting with an LLC, parties know they are dealing with a distinct legal entity, which can simplify legal and financial processes.

Think about it from the client’s perspective. If you’re choosing between two seemingly equal service providers, might the one registered as an LLC feel like a slightly safer or more established bet? Sometimes, perception matters.

Raising Capital

If you anticipate needing significant outside funding – whether from investors or bank loans – your business structure becomes even more critical.

- Sole Proprietorship: Raising capital is challenging. You can’t easily sell shares or ownership stakes. Funding typically relies on personal loans, using personal assets as collateral, or loans based heavily on your creditworthiness. Investors seeking equity are generally not interested in this structure.

- LLC: While not as straightforward for equity investment as a corporation (which issues stock), an LLC is generally much more attractive than a sole proprietorship.

- Loans: Banks often view LLCs more favorably due to their formal structure and limited liability, which can make it easier to secure business loans. However, personal guarantees may still be required, especially for new businesses.

- Investment: LLCs can create different classes of membership interests, allowing them to attract investors who receive a share of the profits or equity. The operating agreement defines how investments work and outlines the rights of investors. Venture capitalists still often prefer C-corporations, but for angel investors or smaller funding rounds, an LLC can be a viable and flexible option.

If growth fueled by external investment is part of your long-term plan, forming an LLC early on (or converting to one) often makes strategic sense.

Which Structure is Right for You?

So, after weighing the pros and cons, how do you make a decision? There’s no single “right” answer – the best choice depends entirely on your circumstances, goals, and risk tolerance.

Ask yourself these questions:

- What is my personal risk tolerance regarding liability?

- Low Tolerance / High Business Risk: If the thought of your assets being exposed to business debts or lawsuits makes you uneasy, or if your business operates in a field with inherent risks (e.g., construction, consulting providing high-stakes advice, businesses with physical locations visited by customers), the LLC’s liability protection is highly recommended.

- High Tolerance / Low Business Risk: If your business has very low liability risk (e.g., freelance writing with minimal client interaction or potential for damages) and you are comfortable with the personal exposure, a sole proprietorship should suffice.

- What are my long-term growth plans?

- Seeking Investment or Significant Growth: If you plan to seek bank loans, attract investors, or scale up your operation, forming an LLC provides a better foundation for credibility and capital raising.

- Staying Small / Lifestyle Business: If you intend to keep the business small, operate primarily on your own, and don’t foresee needing significant outside capital, the simplicity of a sole proprietorship may be adequate.

- How vital is perceived professionalism?

- Dealing with Large Clients / B2B: If your target market includes larger companies or government entities, or if you feel the “LLC” designation will enhance trust, forming an LLC could be beneficial.

- Direct-to-Consumer / Informal Market: If your customers are primarily individuals and the formality of the business structure is unlikely to impact their purchasing decisions, this factor might be less critical, favoring the simplicity of a sole proprietorship.

- What is my budget and tolerance for administrative work?

- Limited Budget / Prefer Simplicity: If minimizing upfront costs and ongoing paperwork are top priorities, the sole proprietorship is the clear winner.

- Willing to Invest for Protection/Flexibility: If you see the filing fees and annual compliance tasks as a worthwhile investment for liability protection and tax flexibility, an LLC is manageable.

Scenarios and Recommendations

Let’s consider some common scenarios:

- The Freelance Writer/Designer (Low Risk): Starts working with a few small clients. Liability risk seems low. Sole proprietorship is often an excellent starting point due to its simplicity and low cost. Consideration: As income grows or clients become larger, reevaluate forming an LLC for liability protection and professional credibility.

- The Consultant (Potentially High Risk): Providing strategic advice where errors could lead to significant client losses. LLC is strongly recommended from the start to protect personal assets from potential lawsuits related to professional advice.

- The E-commerce Store Owner: Selling physical products. Potential liability from defective products, shipping issues, or data breaches (customer information). LLC is advisable for liability protection.

- The Tradesperson (e.g., Plumber, Electrician): Work involves potential property damage or injury. An LLC is highly recommended to shield personal assets from job-site accidents or claims of faulty work.

- The Startup Planning for Investment: A tech startup or other venture aiming for rapid growth and seeking venture capital or angel investors. An LLC is a good starting point, offering protection and some investor appeal; however, conversion to a C-corporation may be necessary later for major funding rounds.

Can You Change Structures?

Yes! Many businesses start as sole proprietorships and later convert to an LLC as they grow, take on more risk, or seek funding. The process typically involves filing the LLC formation documents as described earlier and formally transferring any assets or contracts (if necessary) to the new LLC entity. It’s often simpler to start as an LLC if you anticipate needing one in the future, but converting later is possible.

Conclusion

Choosing between a sole proprietorship and an LLC is one of the foundational decisions you’ll make as a business owner.

A sole proprietorship offers unparalleled simplicity and low cost, making it an easy entry point into the world of business. However, this comes at a significant price: unlimited personal liability, which puts your personal assets at risk for business debts and lawsuits.

An LLC, while requiring more setup effort, cost, and ongoing maintenance, provides the invaluable benefit of limited liability. It creates a legal shield protecting your assets and offers greater tax flexibility and enhanced credibility.

Ultimately, the “right” choice depends on balancing simplicity against protection and considering your specific business activities, risk exposure, and future goals. For many businesses, especially those with employees, contracts, physical locations, or significant growth aspirations, the protection and advantages offered by an LLC make it the preferred structure despite the additional administrative requirements.

Don’t make this decision lightly. Carefully weigh the factors discussed here. And remember, while this article provides information, it’s not legal or financial advice. I strongly recommend consulting with both an attorney and a qualified tax professional to discuss your specific situation before finalizing your business structure. They can provide personalized guidance to ensure you start your business on the proper legal and financial footing. Good luck!

Looking for fresh content?

By entering your email, you agree to receive Elementor emails, including marketing emails,

and agree to our Terms & Conditions and Privacy Policy.